Alternative Investment Funds (AIFs) with Truvest Capital

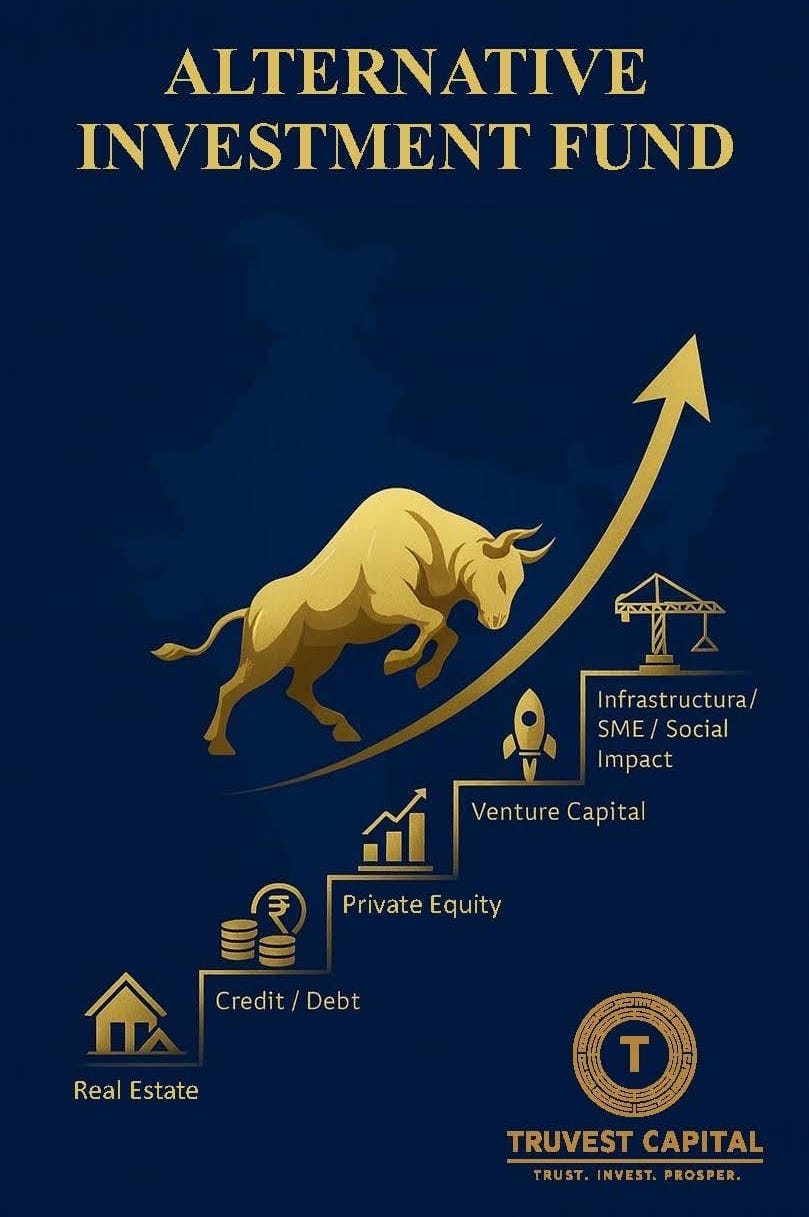

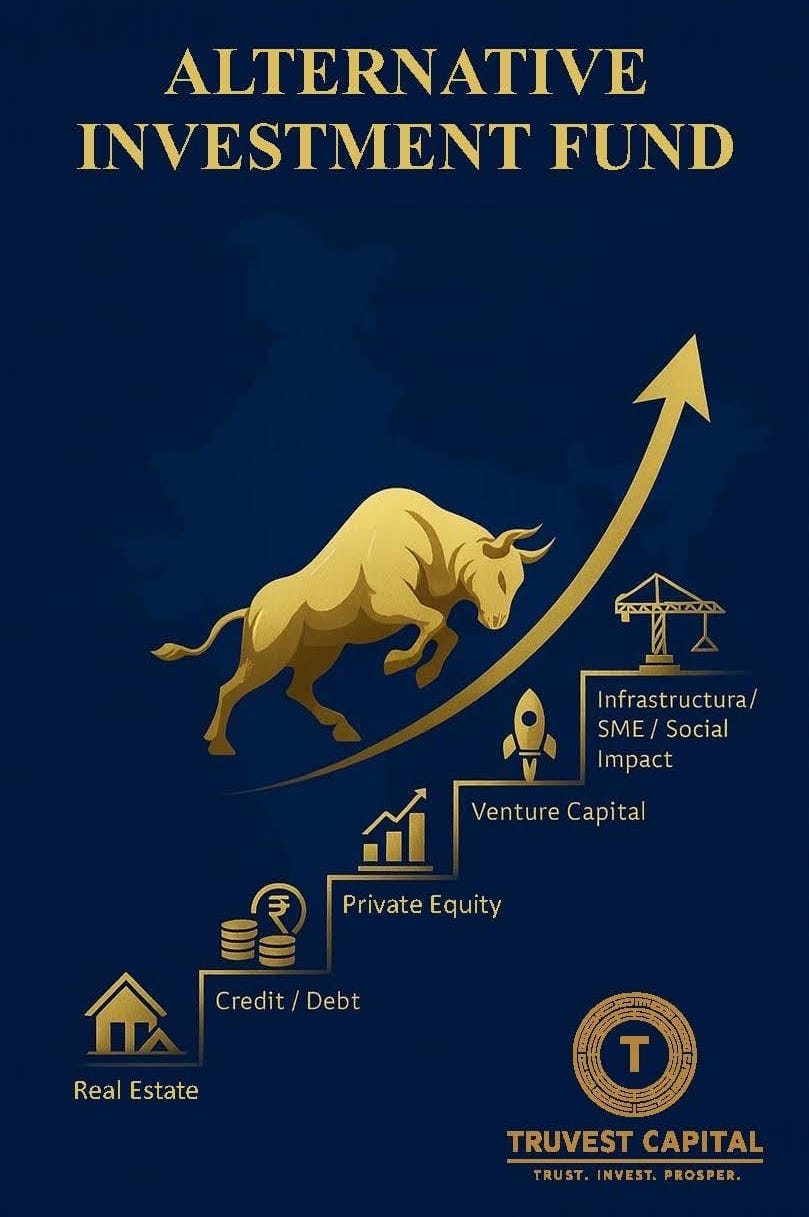

🏛 The Three Pillars of AIFs

- Category I → Venture, Infra, SME, Social Impact (India’s growth backbone)

- Category II → Private Equity, Credit, Real Assets (long-term compounding)

- Category III → Hedge, Quant, Tactical Trading (market-linked alpha)

💼 Truvest Capital Advantage

- Curated access to India’s top AIF managers (PE, Credit, Hedge, VC, Infra)

- Tailored portfolio mapping aligned to your goals, horizon & risk appetite

- Institutional-quality research, due diligence & transparency

- White-glove service → seamless onboarding, monitoring, and reporting

⚖️ Compliance & Disclosures

- Offered only through SEBI-registered AIFs

- No assured returns; performance is market-linked

- Minimum investment: ₹1 crore (SEBI Regulation)

- Investors must review Private Placement Memorandum (PPM) & AIF Agreement before investing