Oct. 4, 2025

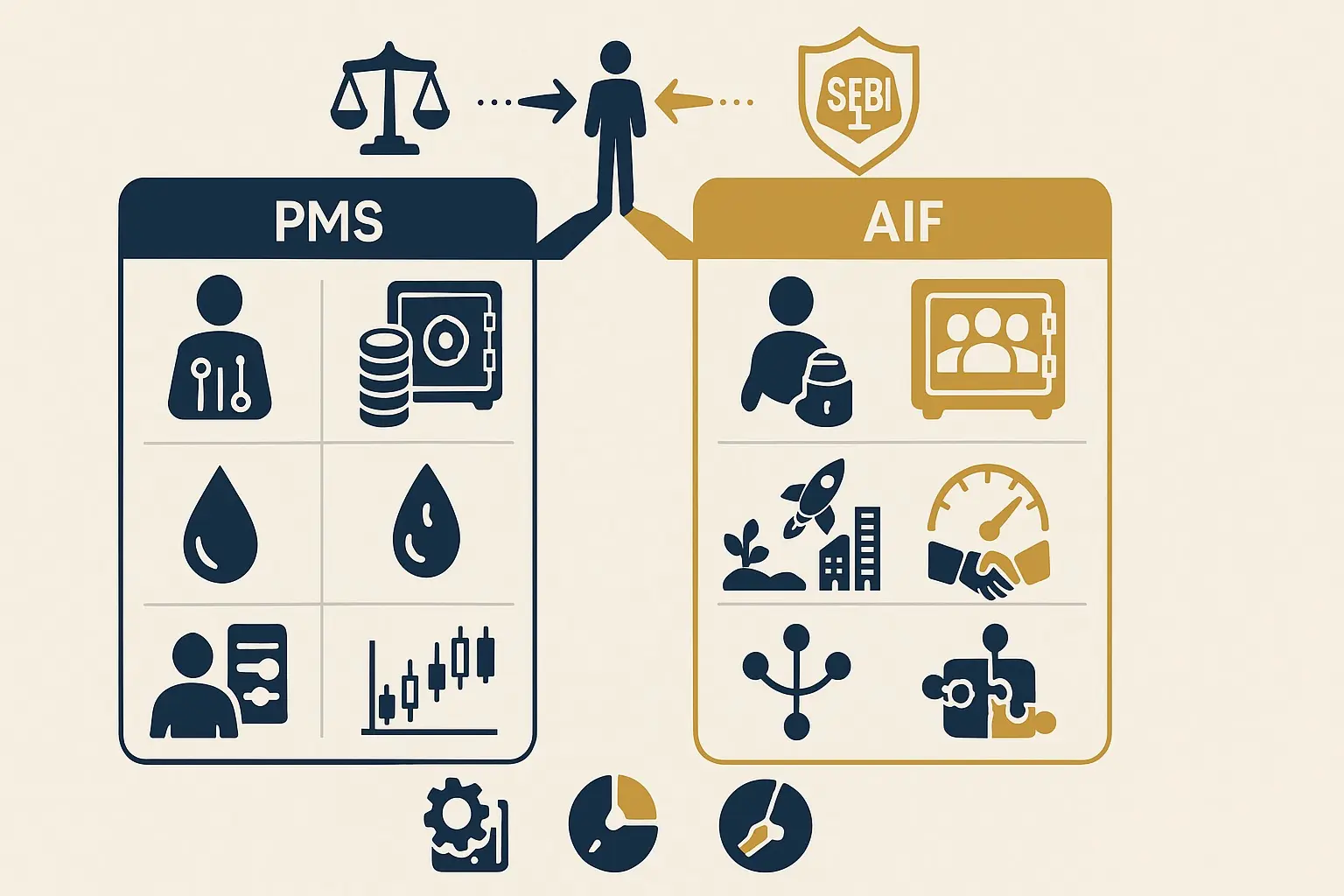

AIF vs PMS: Key Differences Every Investor Should Know

Introduction

HNIs often ask: “Should I invest in AIFs or PMS?” Both are SEBI-regulated but differ in structure, ticket size, liquidity, and risk.

Comparison

- Structure: AIF = pooled vehicle; PMS = individual account.

- Minimum Investment: PMS = ₹50 lakh; AIF = ₹1 crore.

- Liquidity: PMS relatively liquid; AIF has lock-ins.

- Asset Focus: PMS = listed equities/debt; AIF = alternatives like PE, VC.

- Risk: AIFs higher risk/higher return potential; PMS market-linked.

Who Should Invest?

- PMS → for transparent, customized listed equity/debt strategies.

- AIF → for diversification into alternatives.

- Balanced HNIs → often allocate to both.

Key Takeaway

- PMS = Customization + Liquidity.

- AIF = Alternatives + Diversification.

- Together = Complete HNI portfolio.

Disclaimer

This blog is for educational purposes only and does not constitute investment advice. Past performance may or may not be sustained in the future. Investments in AIFs and PMS are subject to market risks. Please consult your SEBI-registered investment advisor before investing.