Benchmarking Private Credit: What Metrics REALLY Matter?

Private credit is not evaluated the way equity PMS or mutual funds are. Traditional benchmarks like Nifty or Sensex do not apply. Instead, investors must look at risk-adjusted, credit-specific metrics.

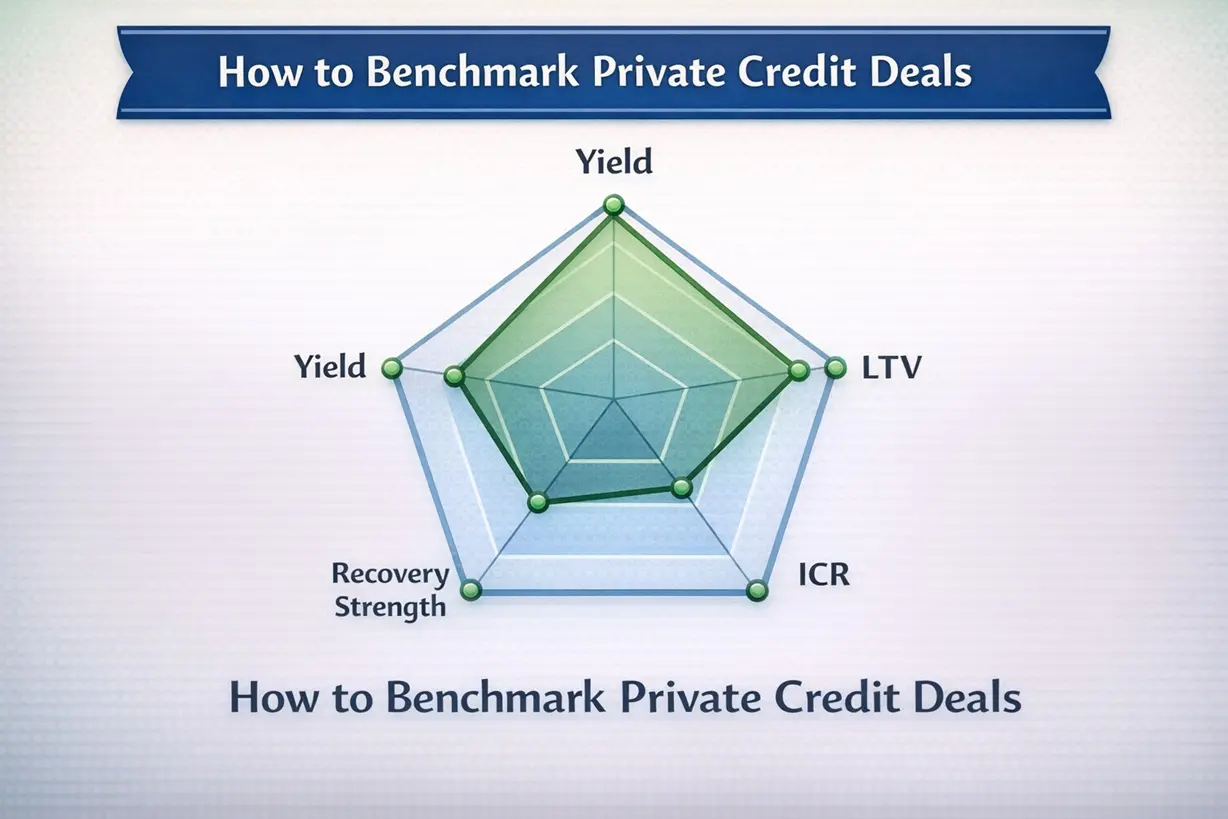

The most important are:

• Gross vs Net Yield

• Default Probability

• Security Coverage Ratio (LTV)

• Interest Coverage Ratio (ICR)

• Recovery Waterfall

• Vintage Defaults in Similar Deals

A high yield is meaningless if protections are weak. A moderate yield becomes attractive if security and covenants are strong.

Most HNIs focus on coupon — but institutions focus on downside protection first.

Benchmarking private credit is therefore about the balance between yield and safety, not performance versus an index.

Truvest Insight:

Private credit returns are earned through structure, not just interest rate.

Disclaimer:

Educational only. Not investment advice.