Jan. 28, 2026

Building a 2026 HNI Portfolio: PMS + AIF + Private Credit Allocation Guide

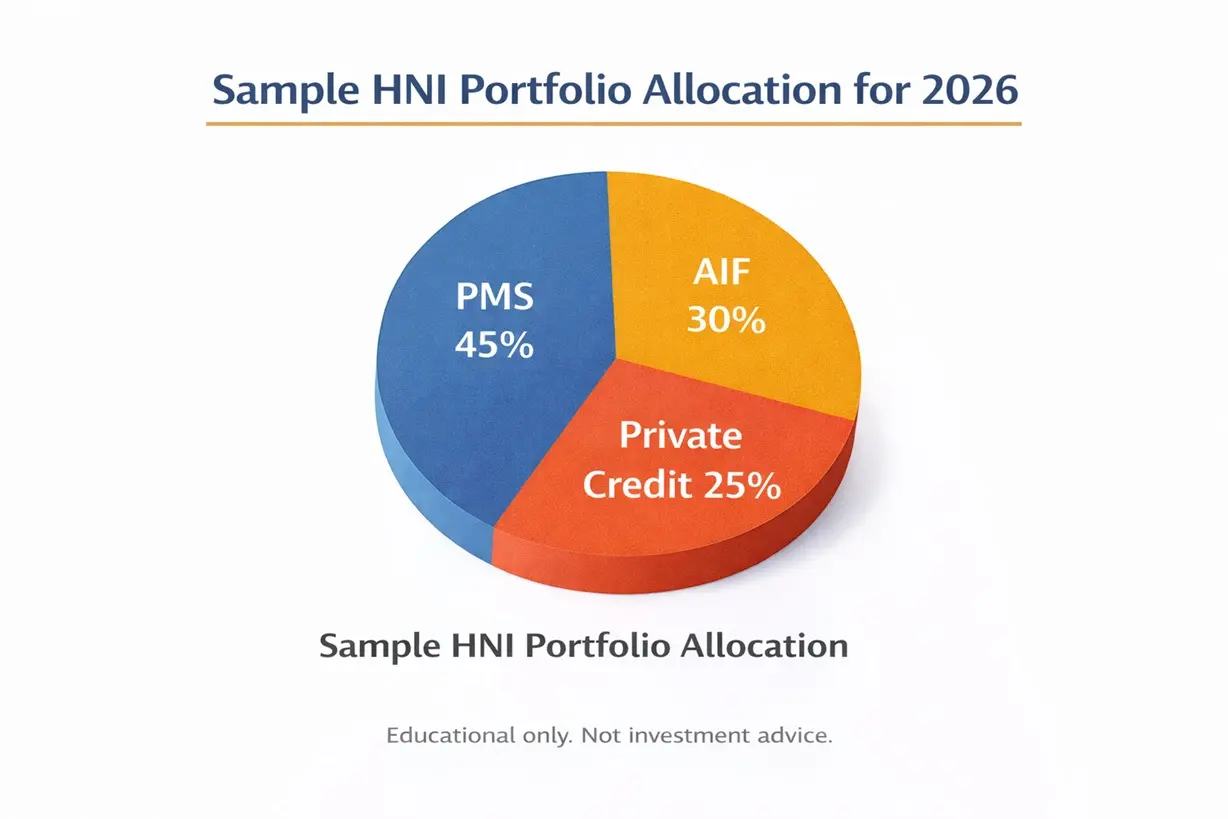

For HNIs, 2026 demands a portfolio that balances liquidity, growth, stability, and long-term compounding. A smart 3-part allocation approach works best:

PMS (Listed Markets):

Liquidity + transparency + long-term equity growth.

AIFs (Private Markets):

Diversification + access to PE/VC/real assets.

Private Credit:

Steady cash yields + secured downside protection.

The exact mix depends on risk appetite, but a well-constructed portfolio typically holds:

• 40–50% PMS

• 25–35% AIFs

• 15–25% Private Credit

This creates a blend of liquidity, long-term compounding, and stable income.

Truvest Insight:

The smartest portfolios don’t chase returns — they balance them.

Disclaimer:

Educational only. Not investment advice.