Building a Balanced HNWI Portfolio – Integrating PMS, AIF & Global Assets

After a month of learning about structures, risks, and governance, let’s put it all together. Wealth management is ultimately a design exercise — allocating across listed, unlisted, and global opportunities to balance growth, liquidity, and preservation.

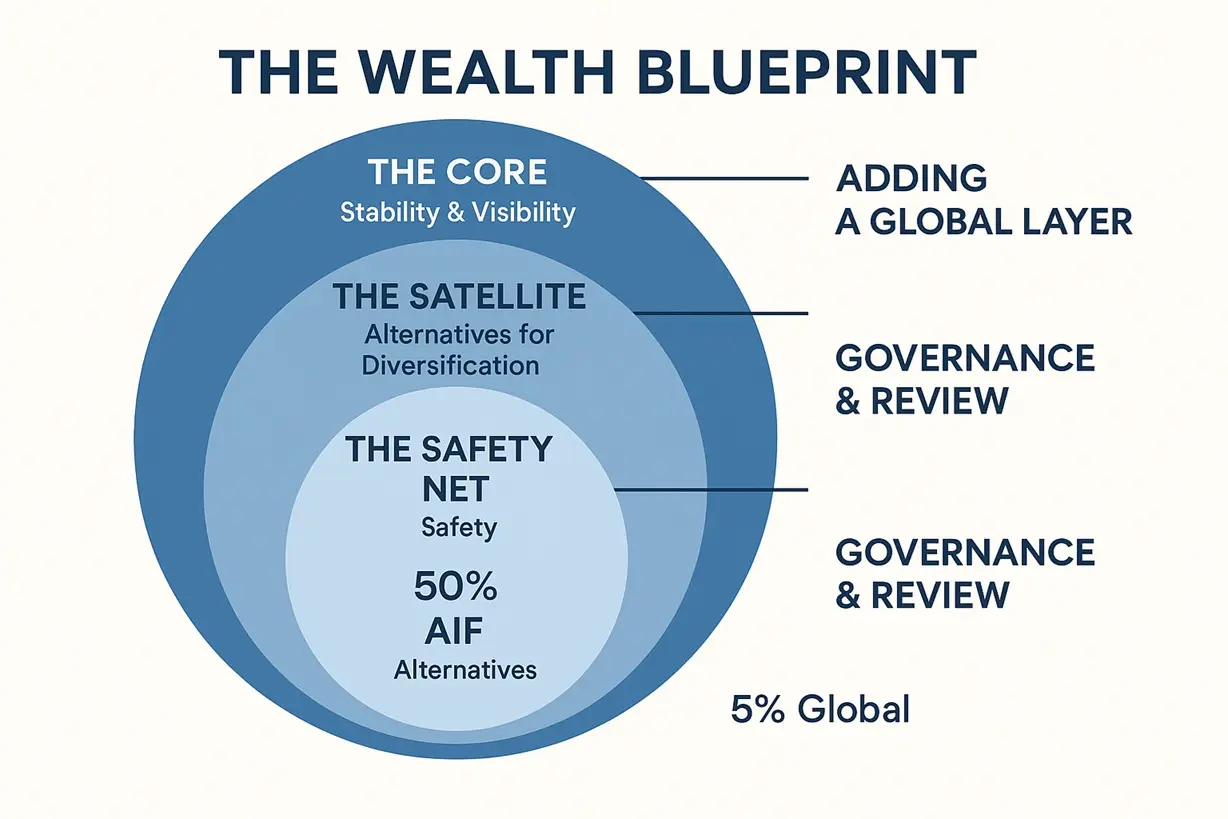

1️⃣ The Core – Stability & Visibility

Your PMS or listed-equity sleeve forms the core of wealth — transparent, daily-valued, and market-linked. Focus on 60 – 70 quality holdings, diversified across sectors and styles. This portion anchors liquidity and benchmark participation.

2️⃣ The Satellite – Alternatives for Diversification

AIFs (Category I & II) add uncorrelated return sources through private equity, venture capital, and credit. Category III AIFs provide hedge-style risk balance. Together, these create an all-weather engine beyond public markets. The satellite allocation (20–40 %) depends on horizon and liquidity tolerance.

3️⃣ The Safety Net – Debt & Cash Buckets

Even the most aggressive HNIs need stability reserves. Allocate 10 – 15 % to short-term debt, T-Bills, or money-market instruments to manage capital calls, lifestyle, and emergency needs.

4️⃣ Adding a Global Layer

A truly balanced HNI portfolio now spans continents. Global ETFs or feeder AIFs in GIFT City enable exposure to U.S. tech, European dividends, or Asian commodities — hedging currency and geographic risk.

5️⃣ Governance & Review Cycle

Structure dictates success. Every quarter, review: allocation drift, risk metrics, drawdowns, and liquidity buckets. Annual “Alternatives Audit” ensures PMS and AIFs stay within mandate. Document each review — institutional investors always do.

Example Framework (illustrative only)

- 50 % PMS (core equity)

- 30 % AIF (private equity + credit blend)

- 15 % Debt and cash reserve

- 5 % Global ETFs / Feeder Funds

Key Takeaway: Asset allocation is a living blueprint — PMS gives transparency, AIFs add differentiation, and liquidity reserves ensure peace of mind. Together, they turn wealth into a well-managed enterprise.

Disclaimer: For educational purposes only; not investment advice or allocation recommendation. Please consult your SEBI-registered investment advisor and tax expert before implementing any portfolio strategy.