Dec. 26, 2025

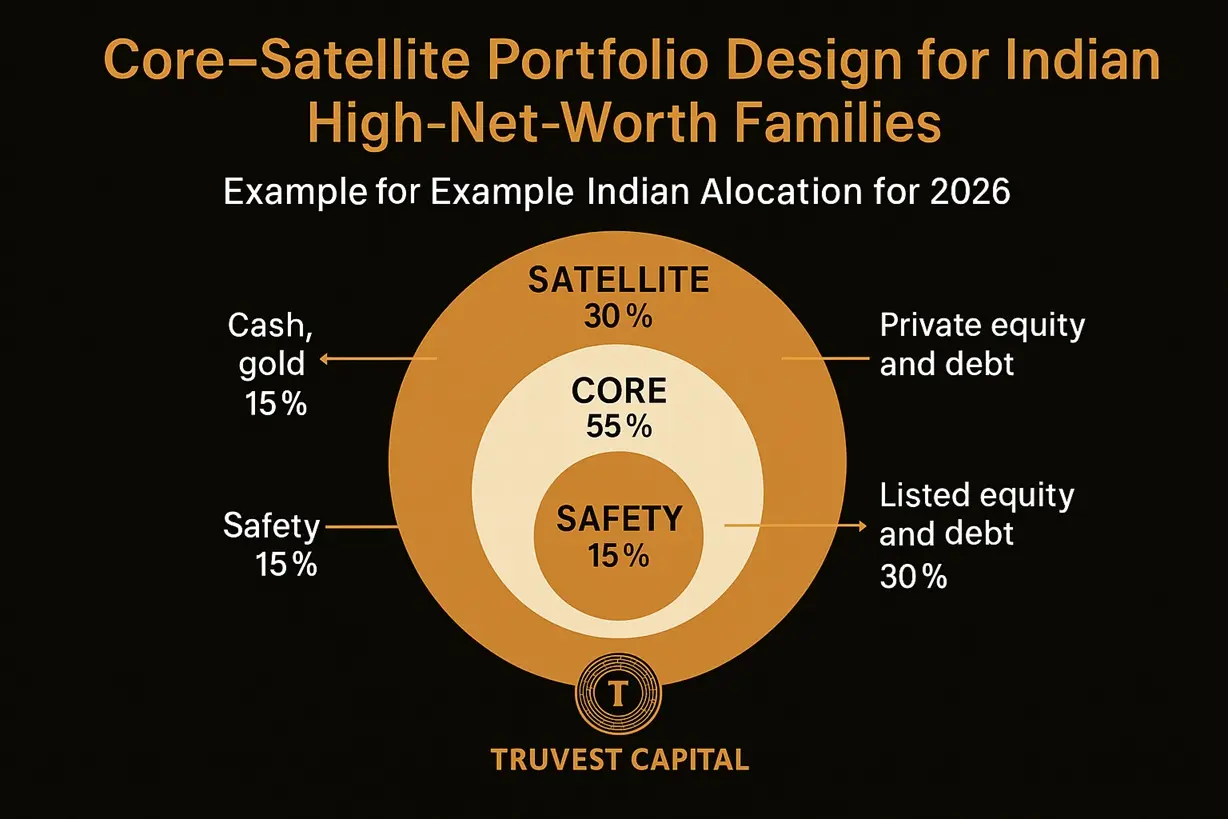

Core–Satellite Portfolio Design for Indian High-Net-Worth Families

Overview:

Global family offices blend a “core” of transparent listed assets with “satellite” alternative strategies. India is rapidly converging to that model.

Key Points:

- Global mix (median): 50–60 percent listed equity and high-quality debt (core); 30–40 percent private equity, private credit, real assets, hedge-style funds (satellite); 5–10 percent cash and gold for liquidity.

- India 2025 mix (median among large families): 55 percent listed equity and debt, 30 percent alternatives, 15 percent cash and gold—satellite is expanding by 3–5 percentage points each year.

- Rationale: core = daily liquidity and market beta; satellite = diversification and specialist alpha; liquidity bucket = capital-call readiness and emergencies.

- Risk math: portfolios with a 30–35 percent satellite sleeve showed ≈ 20 percent lower peak-to-trough decline during 2020 and ≈ 1.5–2.0 percentage points higher five-year annualised return than all-public portfolios.

- India’s accelerants: private credit yields (often 11–15 percent), infrastructure concessions, and environmental, social and governance real-asset platforms.

- Design guardrails: single-manager exposure < 15 percent of total net worth; sector exposure < 25 percent; liquidity buffer 12 months of lifestyle and future capital calls.

Truvest Capital Insight:

Balance is a policy, not a feeling—write your percentages, then live by them.

Disclaimer:

Educational content only. Not investment advice.