Currency Risk for NRIs Investing in India: A Practical Wealth Framework

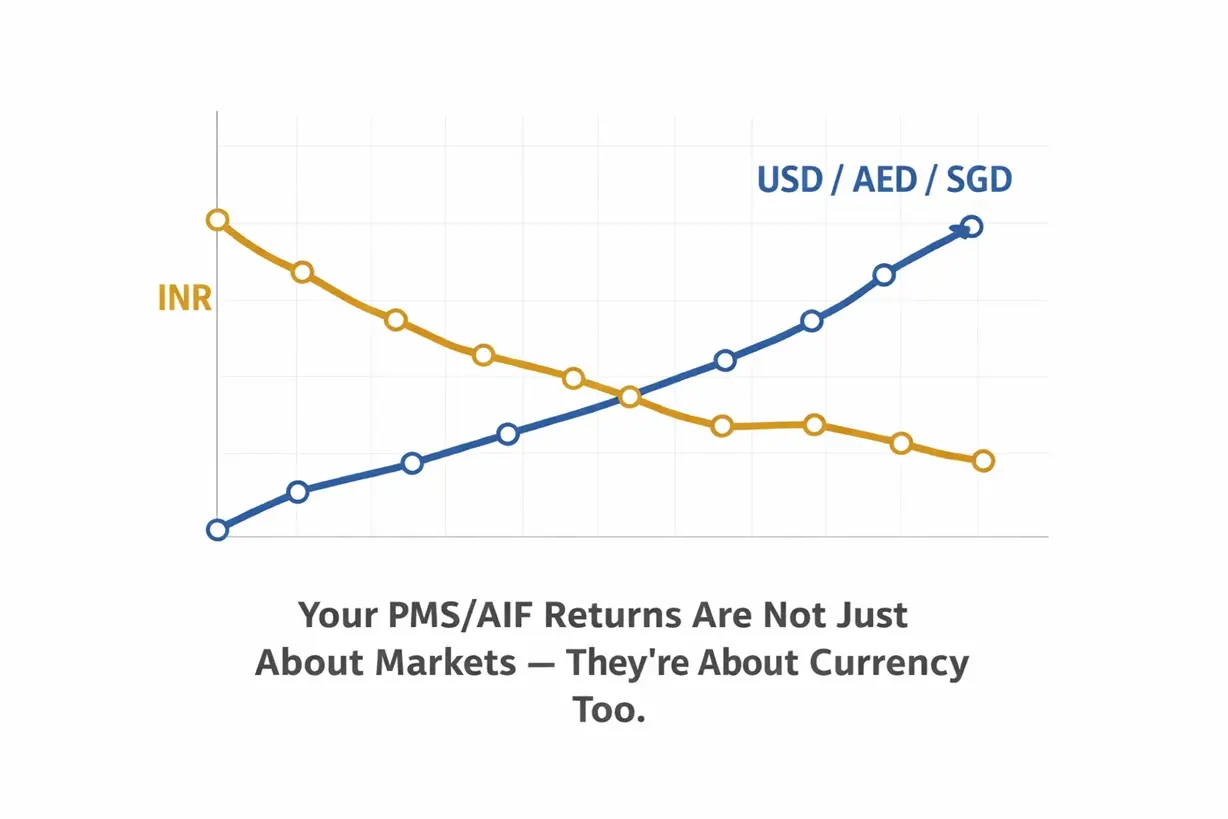

NRIs increasingly invest in PMS, AIFs, and private credit — but often underestimate currency risk. INR depreciation against USD, AED, or SGD can significantly alter real returns when funds are repatriated.

Understanding this risk is crucial:

• An 11% PMS return in INR may become 6–7% in USD depending on the currency cycle.

• AIF returns with long lock-ins face multi-year currency exposure.

• Private credit yields may protect better due to high coupons.

The goal is not to avoid currency risk — but to manage it. NRIs should map their objectives:

• Are returns needed in India?

• Or will they be repatriated abroad?

• What is the base currency of future spending?

Tools like staggered remittances, hedging products, asset diversification, and GIFT City structures help reduce risk.

Truvest Insight:

For NRIs, currency is a hidden asset class — ignore it at your own cost.

Disclaimer:

Educational only. Not investment advice.