Evergreen Structures: How Wealthy Families Invest for Multiple Generations

Evergreen Structures: How Wealthy Families Invest for Multiple Generations

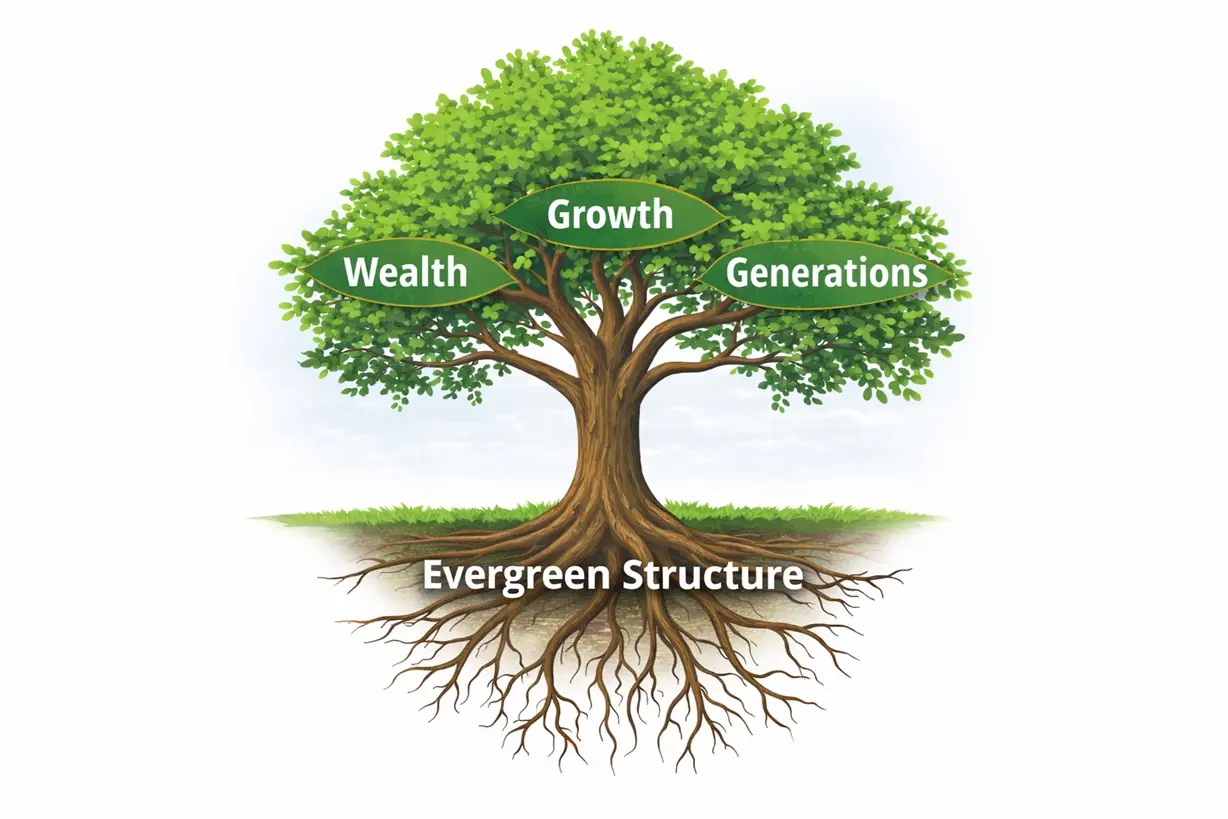

Globally, family offices use evergreen structures — open-ended investment vehicles with no fixed maturity — to grow and preserve wealth across generations. India’s wealthy families are now adopting similar models.

Unlike closed-end funds (like AIFs) with a 7–10 year life, evergreen structures allow perpetual compounding. Assets can be bought, sold, reinvested, or distributed without the pressure of forced exits.

Benefits include:

• Long-term compounding without interruption

• Ability to hold high-quality private assets indefinitely

• Flexible distributions for family needs

• Professional governance similar to global family offices

HNIs often combine evergreens with trusts to create a seamless, multi-generational wealth engine.

Truvest Insight:

The world’s richest families don’t invest for 5 years — they invest for 50.

Disclaimer:

Educational only. Not investment advice.