Dec. 1, 2025

Evolution of India’s Alternative Investment Landscape – From Emerging to Established

Overview:

Over the last decade, India’s Alternative Investment ecosystem has moved from infancy to global relevance. The shift from domestic high-net-worth participation to international institutional involvement marks a key turning point.

Key Points:

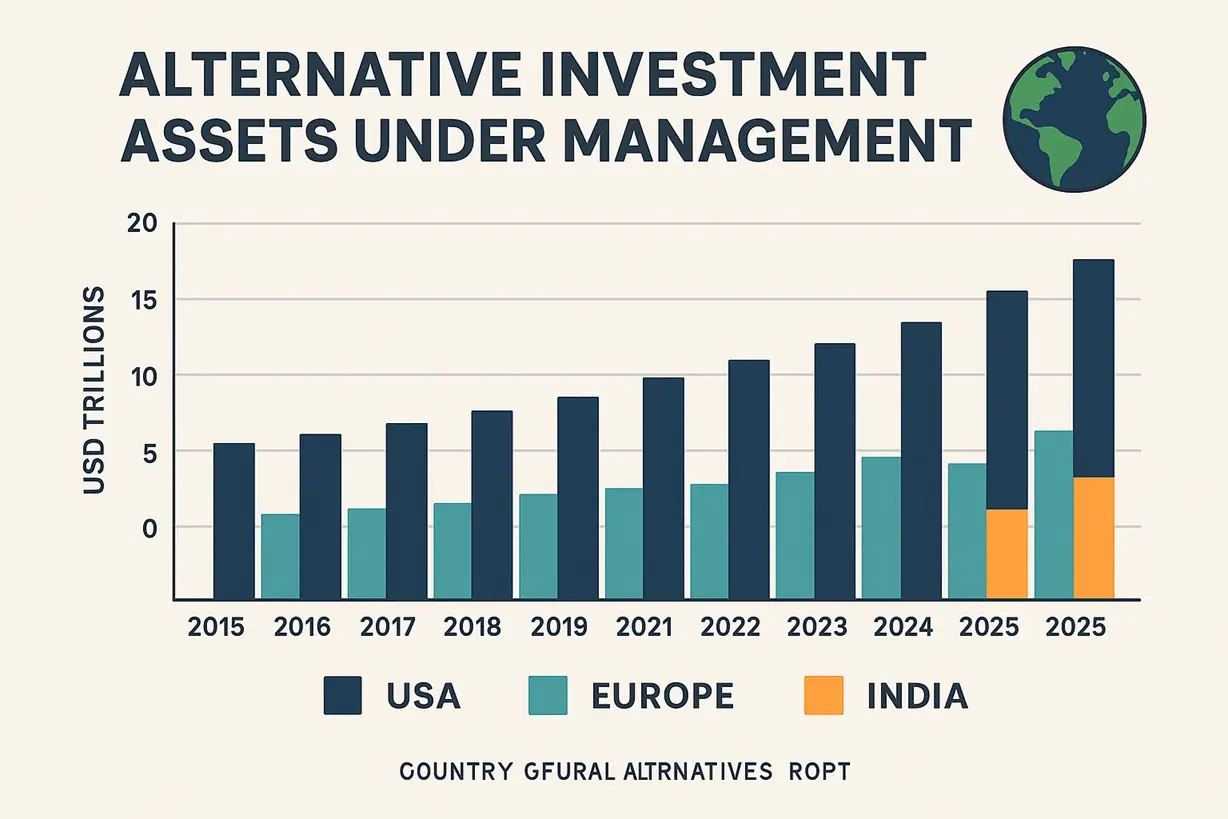

- Globally, the total Alternative Investment industry crossed USD 15 trillion in 2025, growing at a 9.8 % CAGR since 2018 (Preqin Global Alternatives Report).

- India, though smaller, is the fastest-growing market — ₹9.1 lakh crore (USD 110 billion) in total Alternative Investment Fund commitments as of FY 2025, a 27 % CAGR since 2016.

- In contrast, China’s Alternative industry grew only 11 % CAGR, while developed markets such as the United States stabilized around 6–7 % CAGR.

- The regulatory environment in India, driven by SEBI, introduced strict valuation, custody, and audit mandates that raised governance to near-global standards.

- Family offices, sovereign funds, and global pension investors are increasingly using GIFT City to channel funds into Indian private credit, real estate, and infrastructure opportunities.

- India’s Alternative Investment depth-to-GDP ratio stands at 3.1 %, compared to the United States (45 %) and Singapore (12 %) — signalling enormous runway for domestic growth.

- By 2030, India’s Alternative Asset industry is projected to reach USD 280–300 billion, positioning it as Asia’s second-largest private capital hub after China.

Truvest Capital Insight:

India’s decade of discipline has built trust; the next will build scale. Alternatives here are not just catching up—they’re converging with global standards.

Disclaimer:

Educational content only. Not investment advice. Investments in Alternative Investment Funds or Portfolio Management Services are subject to market risks. Please consult your SEBI-registered advisor before investing.