Global Access to Indian Opportunities — Understanding Feeder and Master-Feeder AIF Structures

Global investors—from London family offices to Singapore funds—are increasingly using feeder structures to access India’s growth story compliantly. For Indian managers, this bridge brings international capital; for NRIs, it simplifies cross-border participation.

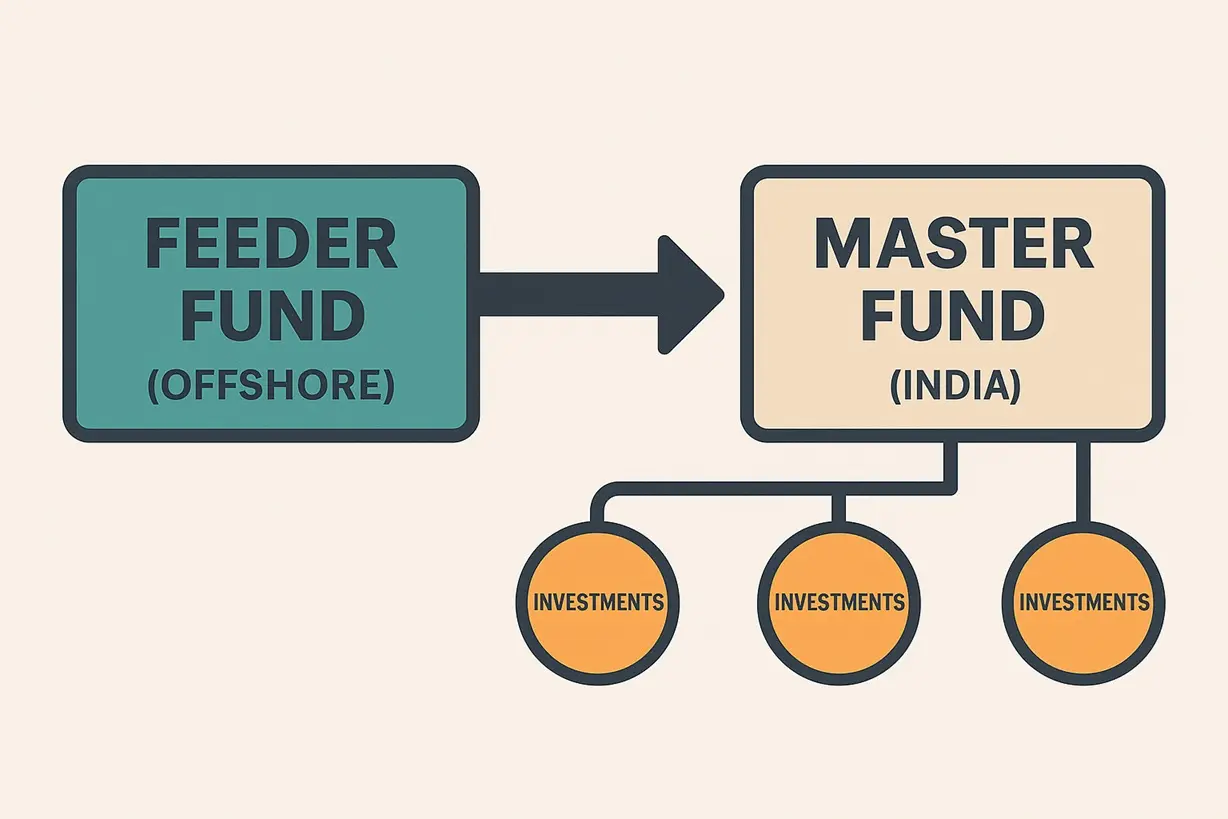

How It Works

A feeder fund collects capital overseas (say, Mauritius, GIFT City IFSC, or Singapore) and channels it into an onshore master fund registered as an Indian AIF. The feeder handles FX conversions, KYC, and local regulations, while the master invests in Indian assets.

Benefits for Investors

- Ease of Compliance: One offshore subscription instead of multiple Indian registrations.

- Tax Efficiency: Often structured under favourable DTAA jurisdictions.

- Aggregation: Pooling global HNI capital for scale.

Considerations

Currency risk, repatriation rules, and layered costs need review. Ask your advisor for documentation that clarifies how capital flows between feeder → master → portfolio companies.

Key Takeaway: Feeder vehicles globalise India’s AIF landscape—but governance, taxation, and FX management define success.

Disclaimer: Educational only; consult legal/tax counsel before investing.