Oct. 19, 2025

Global Alternatives – Lessons for Indian Investors

Introduction

Globally, alternative investments form a major part of HNI portfolios. Indian investors can learn from these practices as AIFs and PMS gain traction.

Global Context

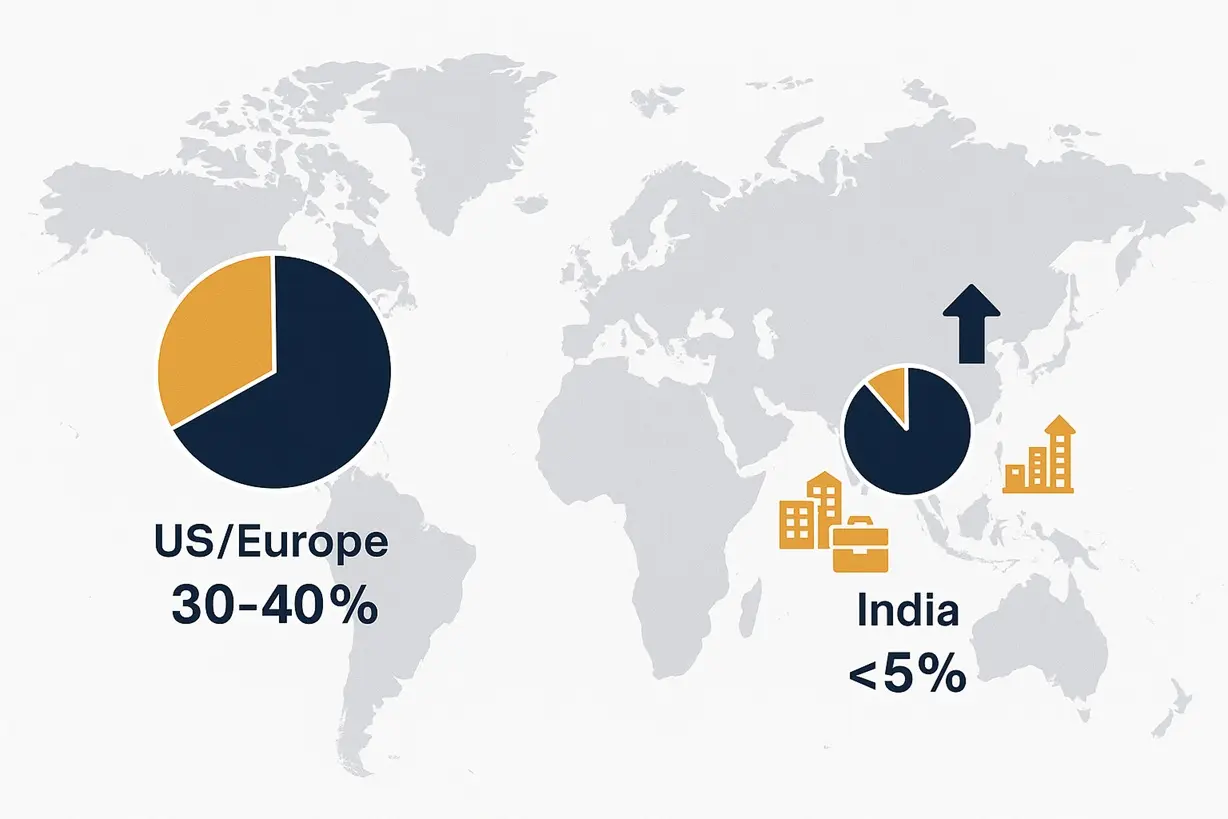

- US/Europe HNIs: 30–40% in alternatives (private equity, hedge funds, real assets).

- India: Alternatives still <5% for most HNIs, but growing fast.

What India Can Learn

- Diversify across listed + unlisted assets.

- Use professional managers for niche strategies.

- Align allocations with long-term wealth goals.

Key Takeaway

- Alternatives are mainstream globally.

- Indian HNIs adopting them gradually via AIFs and PMS.

Disclaimer

This blog is for educational purposes only and does not constitute investment advice. Past performance may or may not be sustained in the future. Investments in AIFs and PMS are subject to market risks. Please consult your SEBI-registered investment advisor before investing.