Dec. 27, 2025

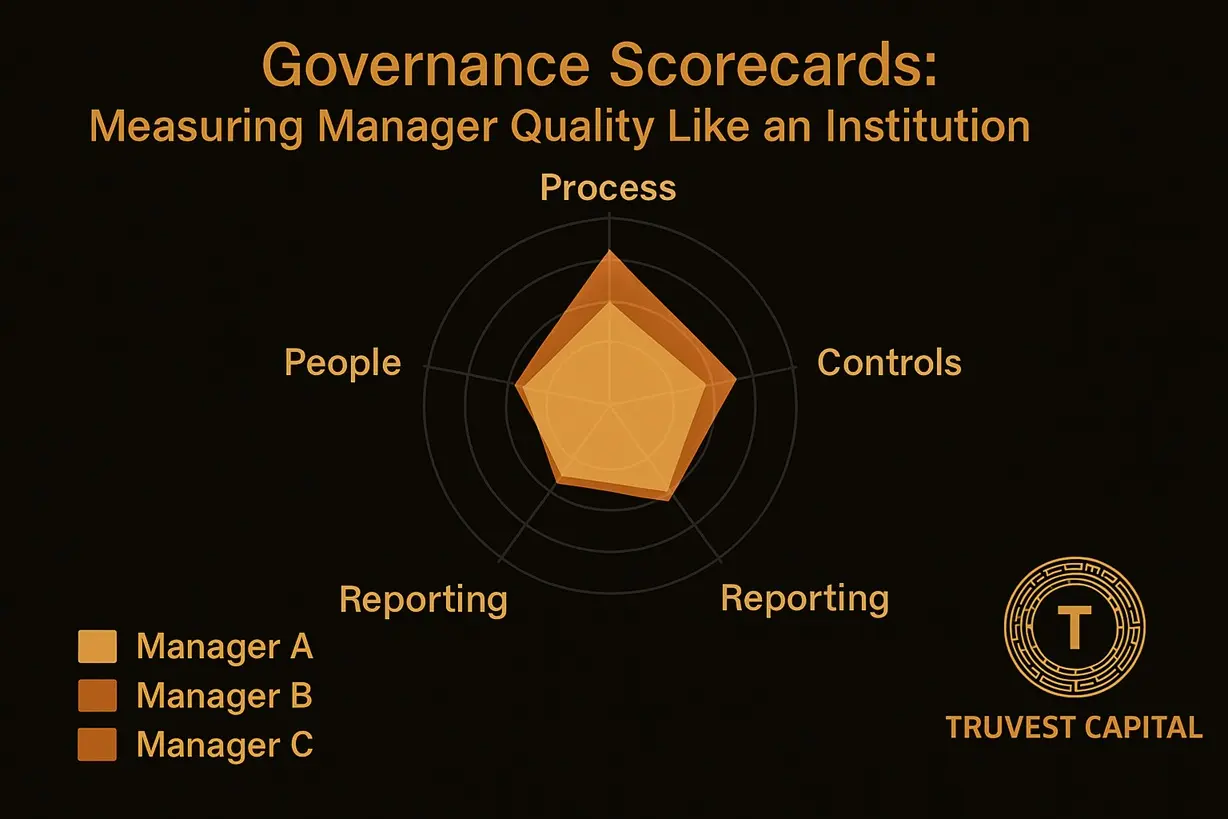

Governance Scorecards: Measuring Manager Quality Like an Institution

Overview:

Institutions rate managers on systems, not sales decks. Indian families can adopt the same “governance scorecard.”

Key Points:

- Suggested pillars (equal weight): Process, People, Controls, Reporting, Alignment.

- Process: documented investment policy, drawdown discipline, loss-cut protocol; world-class if policy breaches < 2 percent of trades.

- People: partner tenure > 7 years, team turnover < 10 percent; succession plan on file.

- Controls: independent trustee, top-tier custodian and auditor, cyber-security reviews; incident rate = zero.

- Reporting: quarterly letters with portfolio actions, risk heat-map (at least 12 metrics), valuation notes; investor queries answered within 10 business days.

- Alignment: sponsor “skin in the game” ≥ 2 percent of fund size; carried-interest escrow with claw-back provisions.

- India vs world: Indian leaders score 8.0–9.0/10 on Truvest Capital’s composite; leading United States and European managers 8.5–9.5/10.

Truvest Capital Insight:

If you cannot score it, you cannot steward it—governance must be quantitative.

Disclaimer:

Educational content only. Not investment advice.