GP-Led vs LP-Led Continuation Funds: What HNIs Must Understand

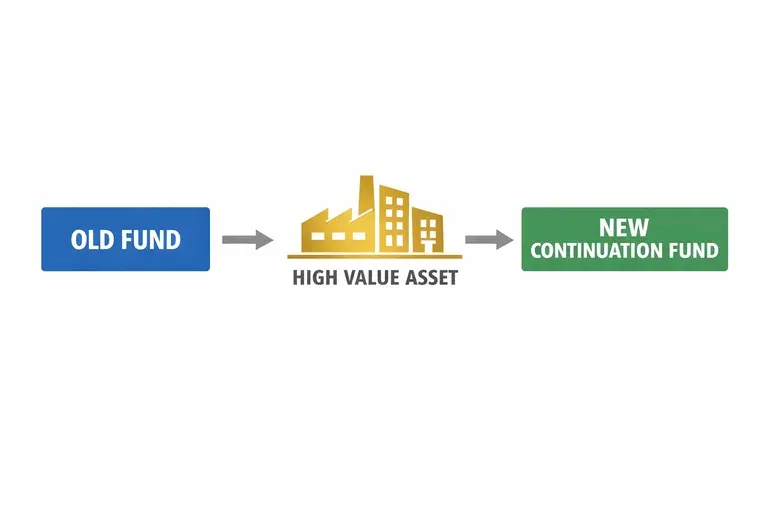

Continuation funds have become one of the biggest trends globally — and now Indian AIFs are beginning to adopt them. They allow fund managers (GPs) to extend ownership of high-performing assets by moving them into a new fund instead of selling prematurely.

In a GP-led continuation fund, the manager identifies strong assets worth holding longer. Existing investors (LPs) can either cash out or roll over into the new structure. This gives investors optional liquidity and gives managers time to maximize value.

In LP-led secondaries, the initiative comes from investors seeking liquidity, not the manager.

For HNIs, the advantage is choice:

• Exit early

• Stay invested in winners

• Or invest fresh capital in already de-risked assets

Continuation funds bring transparency, independent valuation, and institutional-grade governance — all critical for long-term wealth allocation.

Truvest Insight:

Continuation funds turn illiquidity into flexibility for sophisticated investors.

Disclaimer:

Educational only. Not investment advice.