How AIFs Are Structured in India – Trust vs LLP vs Company

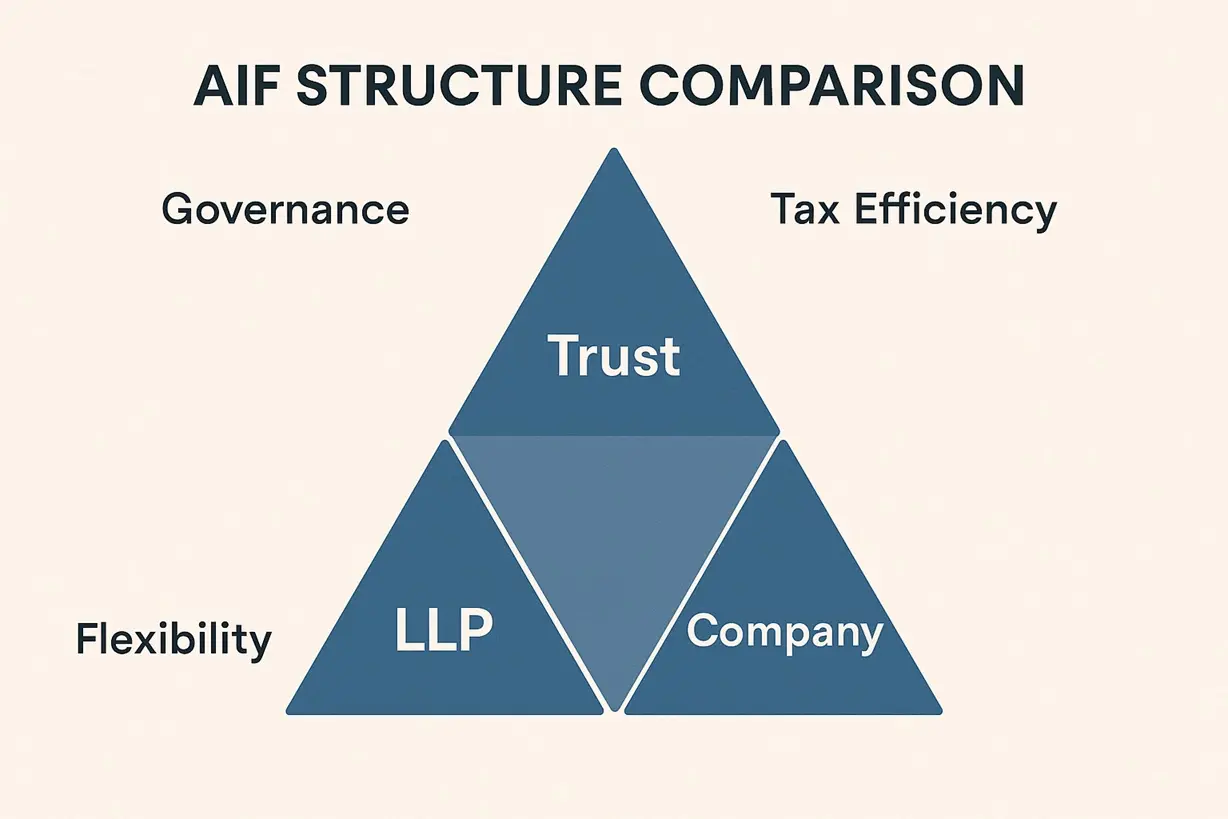

Alternative Investment Funds (AIFs) are privately pooled vehicles that can legally take three shapes—Trust, LLP, or Company. Each affects taxation, investor rights, and compliance overhead.

Trust Structure

Over 95 % of Indian AIFs operate as Trusts. Here, the Sponsor creates a trust deed; the Trustee oversees fund assets; the Investment Manager executes the strategy. This model enables pass-through taxation for Categories I and II (subject to prevailing law) and ensures a clear fiduciary line of accountability.

LLP Structure

An LLP offers flexibility and shared management rights. However, it faces more complex statutory filings and may lack clear pass-through benefits, depending on tax treatment. Suitable for smaller funds with limited investors seeking partnership-style control.

Company Structure

The least used form. A corporate AIF attracts dual taxation (dividend distribution + investor level) and adds Companies Act compliance. Its appeal lies mainly in specific institutional contexts or when foreign participation requires a corporate wrapper.

Why It Matters

Structure defines governance, liability, and exit mechanics. Before subscribing to any AIF, read its Private Placement Memorandum (PPM) to confirm trust deed provisions, trustee names, and tax implications.

Key Takeaway: The Trust model dominates for its clarity and investor safeguards—but always check how your fund is constituted.

Disclaimer: Educational only; consult tax advisors.