Nov. 7, 2025

Inside Private Credit (Category II AIFs) – Yield with Caution

With equity valuations high and rates volatile, private credit AIFs attract HNIs seeking steady yields. But these aren’t fixed deposits.

How It Works

The fund lends to mid-market companies through structured debt, convertibles, or mezzanine instruments. Returns come from interest + equity kickers but depend on timely repayment.

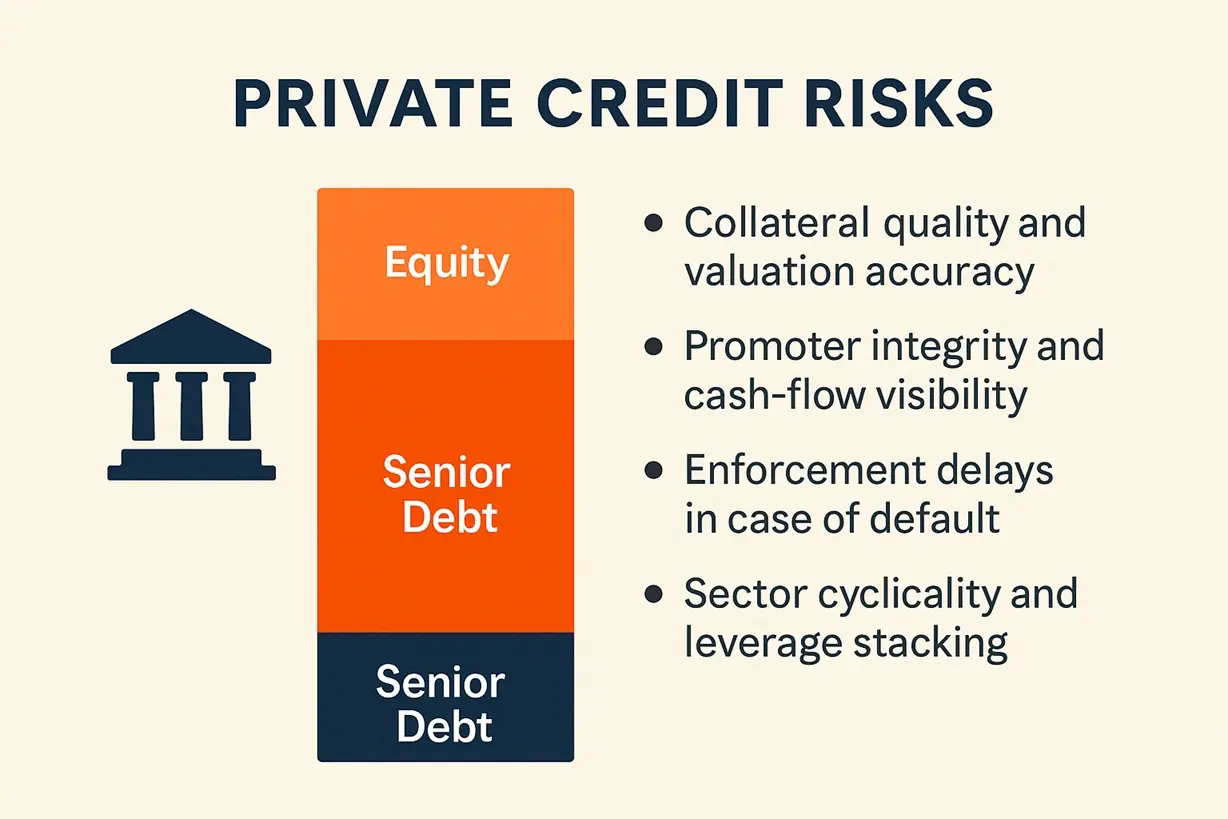

Key Risks

- Collateral quality and valuation accuracy.

- Promoter integrity and cash-flow visibility.

- Enforcement delays in case of default.

- Sector cyclicality and leverage stacking.

Due-Diligence Checklist

Ask for borrower DSCR, LTV ratios, and past default track record. Review escrow structures and security waterfall.

Key Takeaway: Private credit offers yield premium for risk premium – price both correctly.

Disclaimer: Educational only.