Nov. 25, 2025

Investor On-boarding & KYC in AIF/PMS – Compliance Before Capital

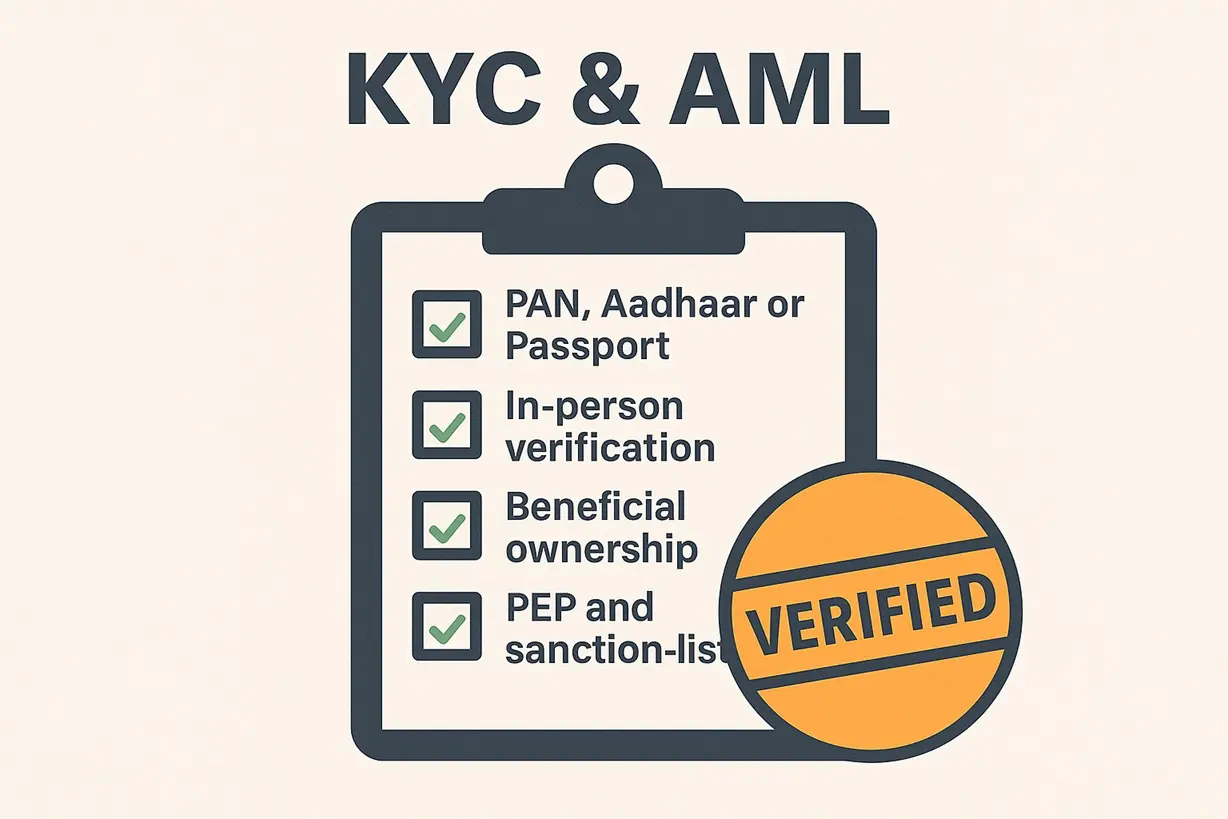

Before money moves, identity must prove itself. KYC and AML procedures form the foundation of India’s regulated wealth industry.

Key Steps

1️⃣ PAN, Aadhaar or Passport verification.

2️⃣ In-person verification or digital video KYC.

3️⃣ Beneficial ownership declaration for entities.

4️⃣ PEP and sanction-list screening.

Best Practice

Submit KYC through KRA and keep address proofs updated to avoid transaction delays.

Key Takeaway: Clean paperwork keeps wealth flows uninterrupted.

Disclaimer: Educational only.