Dec. 19, 2025

Investor Psychology and Risk Perception in Wealth Decisions

Overview:

India’s maturing investor base is starting to behave like developed-market investors—but still battles behavioural traps.

Key Points:

- 64 percent of Indian high-net-worth investors now consult professional managers (up from 39 percent in 2018).

- Average holding period in India = 3.8 years vs global 6.2 years—showing shorter-term bias.

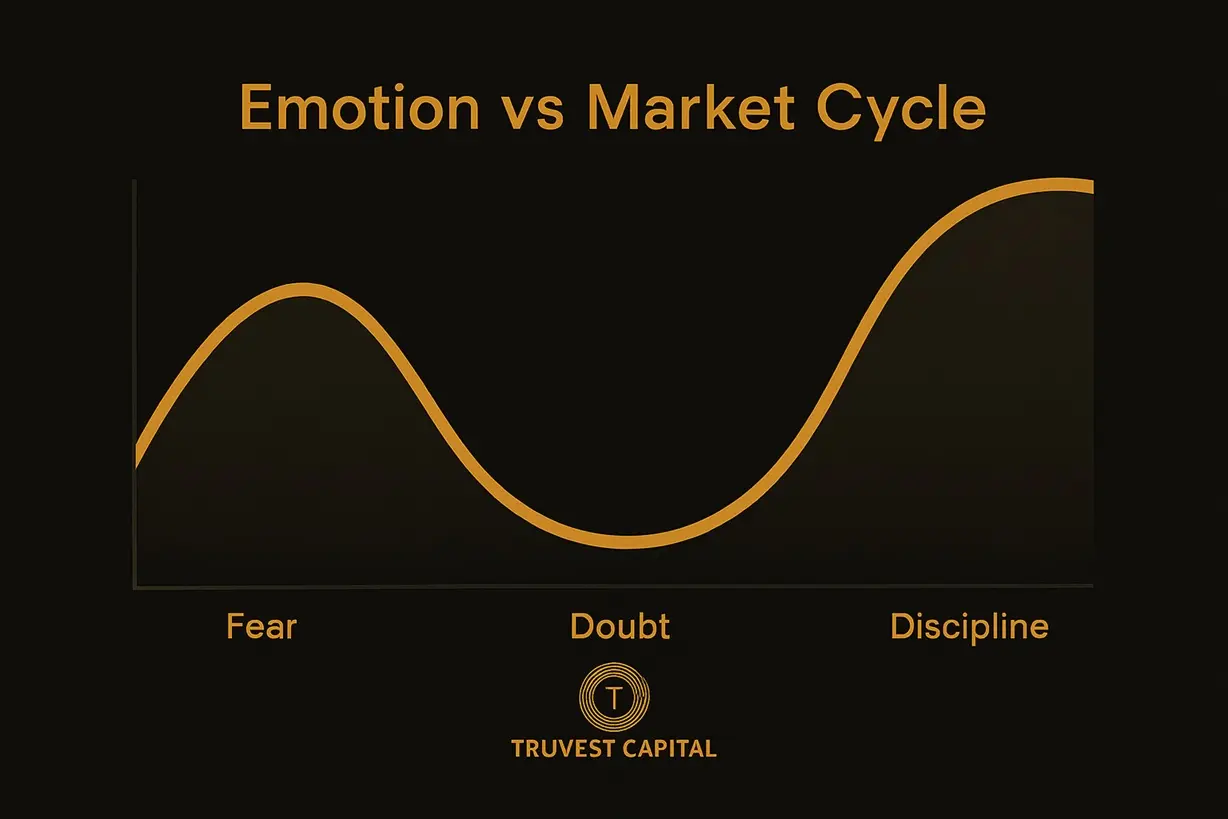

- Fear of drawdowns leads 43 percent of investors to redeem prematurely, missing recovery phases.

- Behaviourally coached clients (those with quarterly advisory reviews) show 27 percent higher long-term returns.

- India’s investor education campaigns under SEBI’s “Smart Investing” initiative reached 1.2 million individuals in FY 2025.

- By 2030, behavioural risk scoring could be part of every wealth account in India.

Truvest Capital Insight:

Behaviour can’t be outsourced—but it can be trained. India’s investors are learning patience is performance.

Disclaimer: Educational content only. Not investment advice.