Dec. 17, 2025

SEBI’s Regulatory Roadmap for 2026: India Steps Up

Overview:

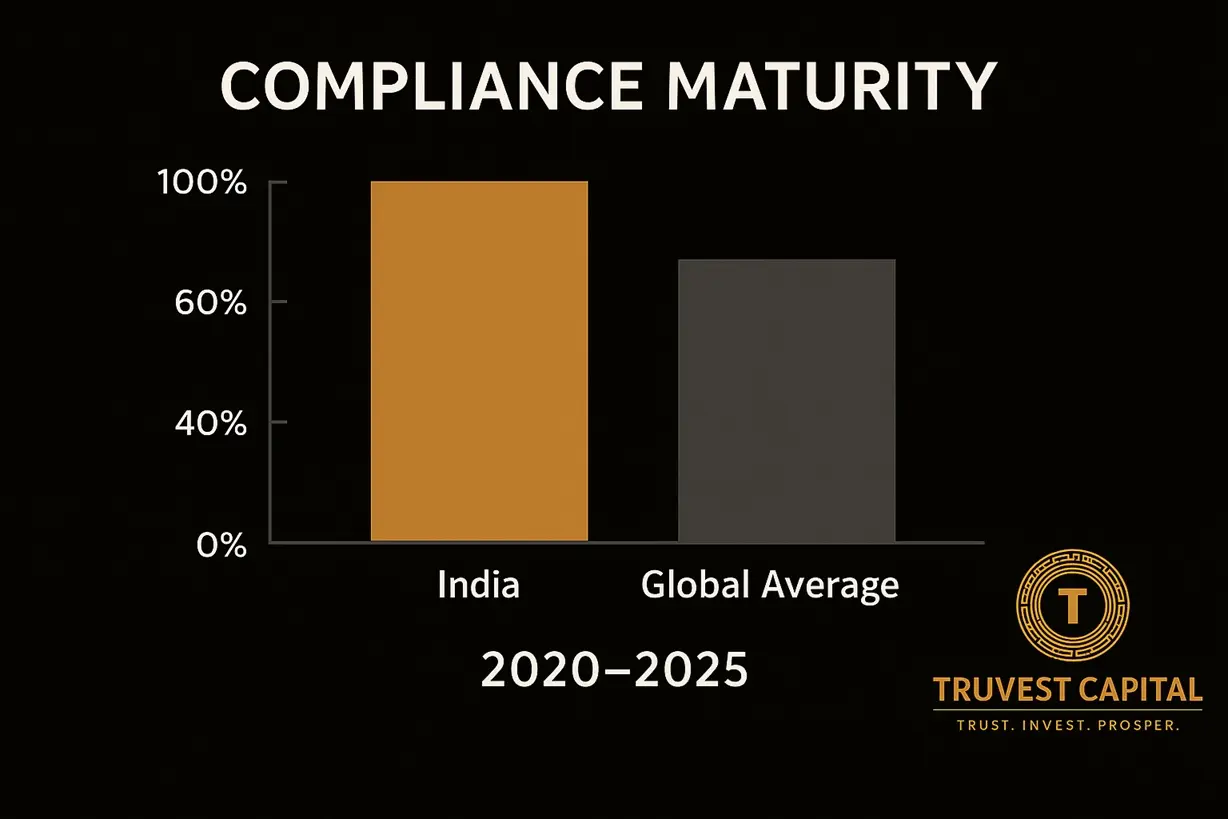

India’s regulatory architecture for Alternative Investments is fast approaching global benchmarks of transparency and investor protection.

Key Points:

- As of 2025, SEBI (Securities and Exchange Board of India) governs 1,300 registered Alternative Investment Funds managing ₹9.1 lakh crore (USD 110 billion).

- Global context: United States SEC oversees ~18,000 private funds with USD 14 trillion AUM; India’s smaller base grows faster (27 percent CAGR vs global 9 percent).

- SEBI’s 2026 roadmap includes:

- Real-time digital filings via the Common Fund Reporting System.

- Cross-validation of valuations using SEBI-accredited databases.

- Mandatory independent trustee certification and quarterly governance score.

- India plans to integrate IFSCA (International Financial Services Centres Authority) data with global regulators through IOSCO by 2027.

- Compliance cost as a percentage of AUM in India = 0.16 percent (vs global average 0.21 percent).

Truvest Capital Insight:

SEBI is building credibility through code—not control—making India one of the most transparent emerging markets.

Disclaimer: Educational content only. Not investment advice.