Secondary Sales in Private Equity: How HNIs Can Benefit

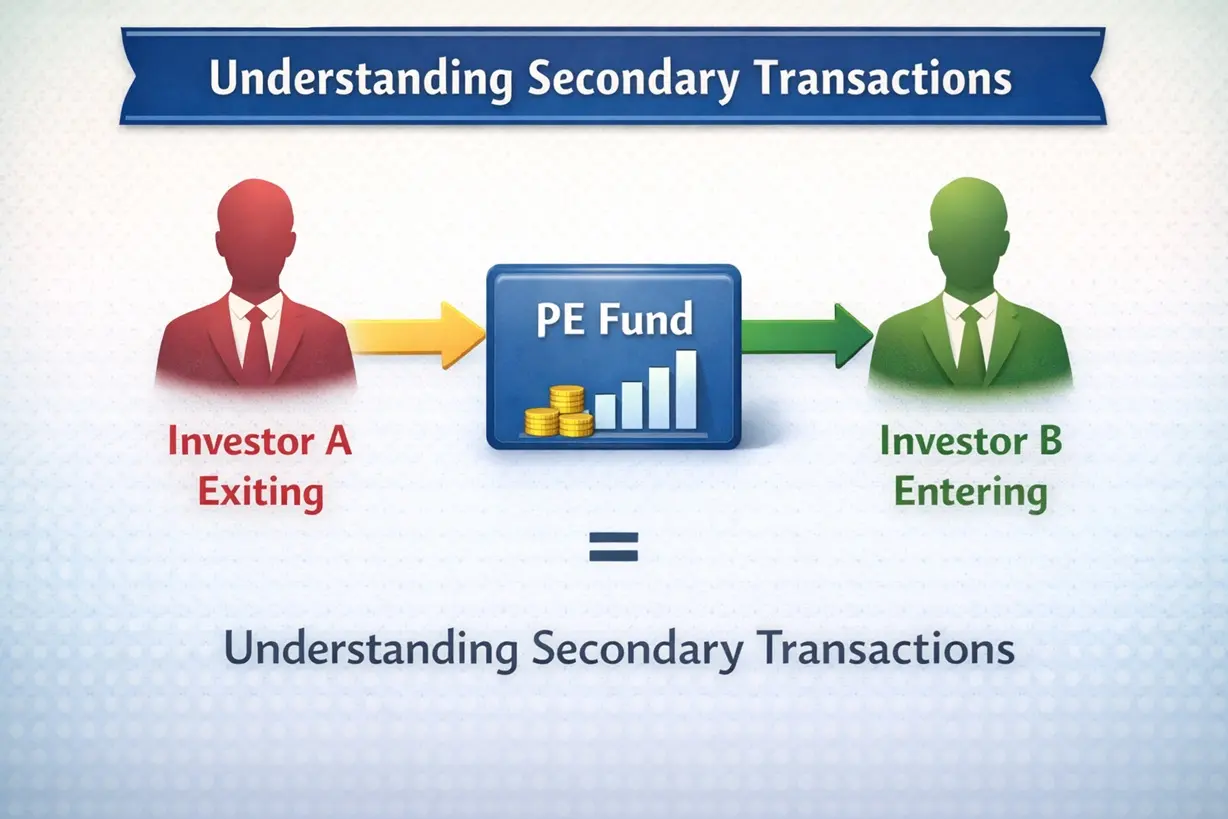

Most investors think private equity returns only come during IPOs or strategic exits. But a growing opportunity is emerging — secondary sales, where investors buy or sell existing fund interests before the fund matures.

Why does this matter? Secondary transactions often happen at discounts, especially in late-cycle funds where investors want liquidity. HNIs with patience can enter strong portfolios after the riskier early-stage years at more attractive valuations.

For sellers, secondaries offer optional liquidity without waiting for the fund’s final exit. For buyers, it provides access to mature assets with clearer visibility.

As India’s private equity market deepens, secondary transactions are becoming a sophisticated tool for portfolio construction.

Truvest Insight:

Secondaries turn illiquid assets into strategic opportunities.

Disclaimer:

Educational only. Not investment advice.