Dec. 13, 2025

Stress-Testing and Scenario Analysis for Resilient Funds

Overview:

Global regulators insist on periodic stress-tests; India has joined them.

Key Points:

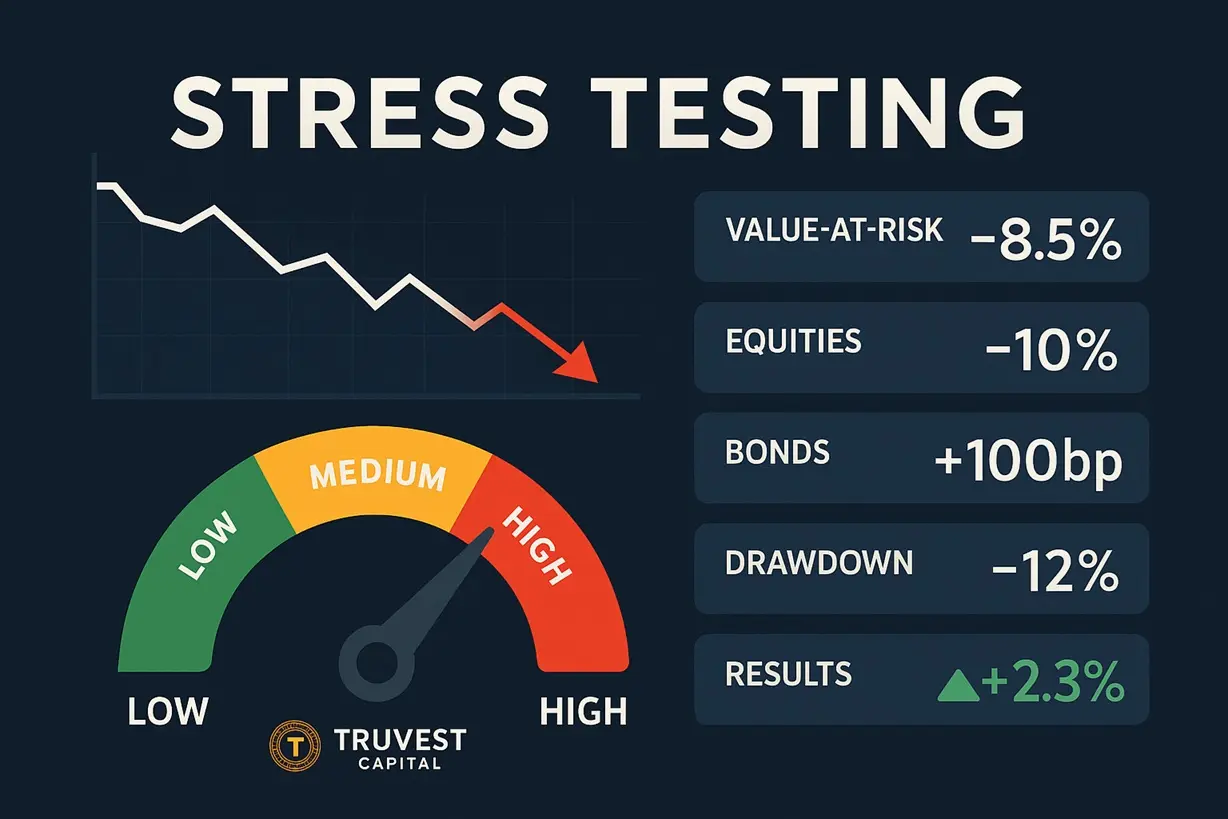

- 84 percent of Category Three funds run monthly Value-at-Risk simulations and interest-rate shock models.

- Standard test: equity drop 10 percent + bond yield rise 100 basis points.

- Indian funds showed median drawdown tolerance –12 percent vs global –10 percent.

- Reports shared with Investment Committees and independent trustees each quarter.

- By FY 2027, SEBI targets mandatory scenario reporting in half-year disclosures.

- Stress-tested funds outperformed non-tested peers by 2.3 percent annualised (Truvest Research 2025).

Truvest Capital Insight:

Resilience is planned, not predicted—India is institutionalising prudence.

Disclaimer: Educational content only. Not investment advice.