Feb. 10, 2026

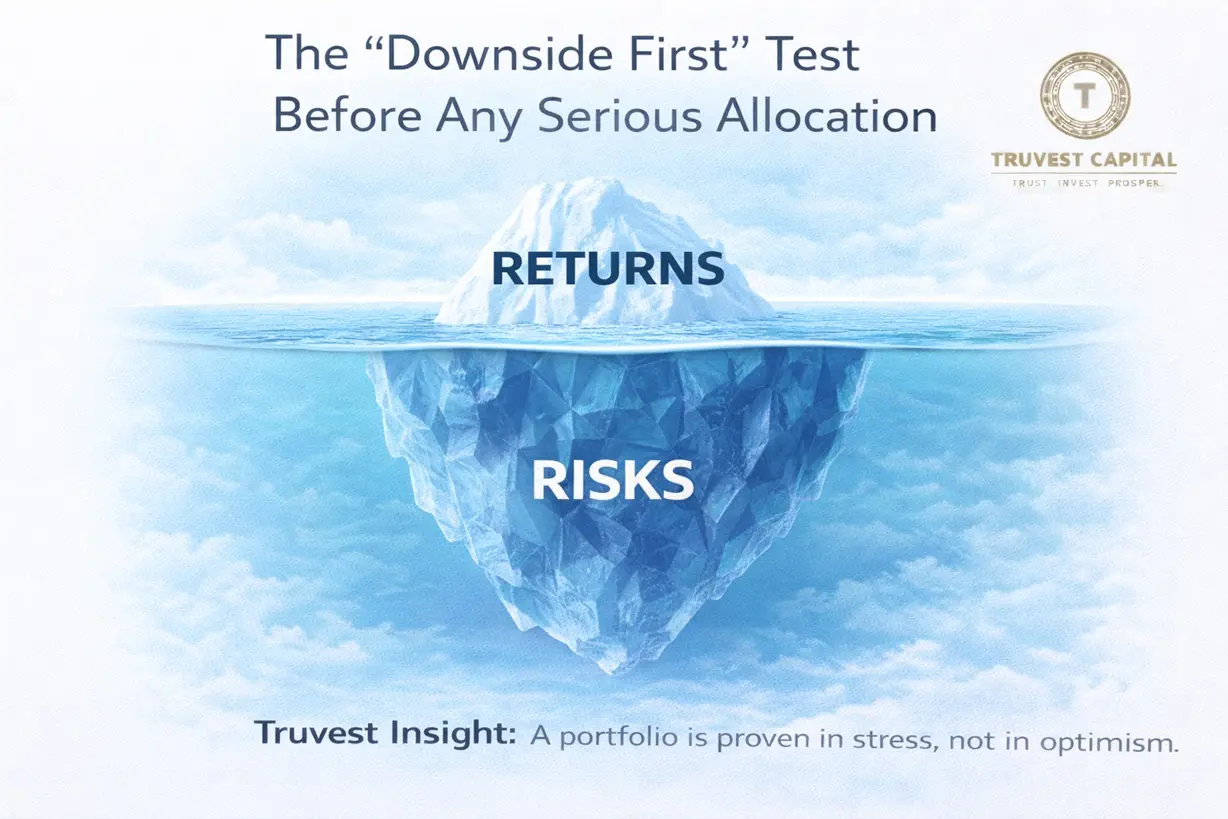

The “Downside First” Test Before Any Serious Allocation

Most people ask: “How much can I make?” Serious investors ask: “How much can I lose—and can I stay invested?” That single shift separates investors from gamblers.

Before you allocate, evaluate downside like a professional: potential drawdown, liquidity constraints, concentration risk, leverage exposure, and stress scenarios. A portfolio that looks great in optimism can become painful in stress.

When you apply the downside-first test, you automatically choose better sizing. You stop over-allocating to exciting ideas. You start building a portfolio you can actually hold through cycles—which is where compounding becomes real.

Truvest Insight:

A portfolio is proven in stress, not in optimism.

Disclaimer:

Educational only. Not investment advice.