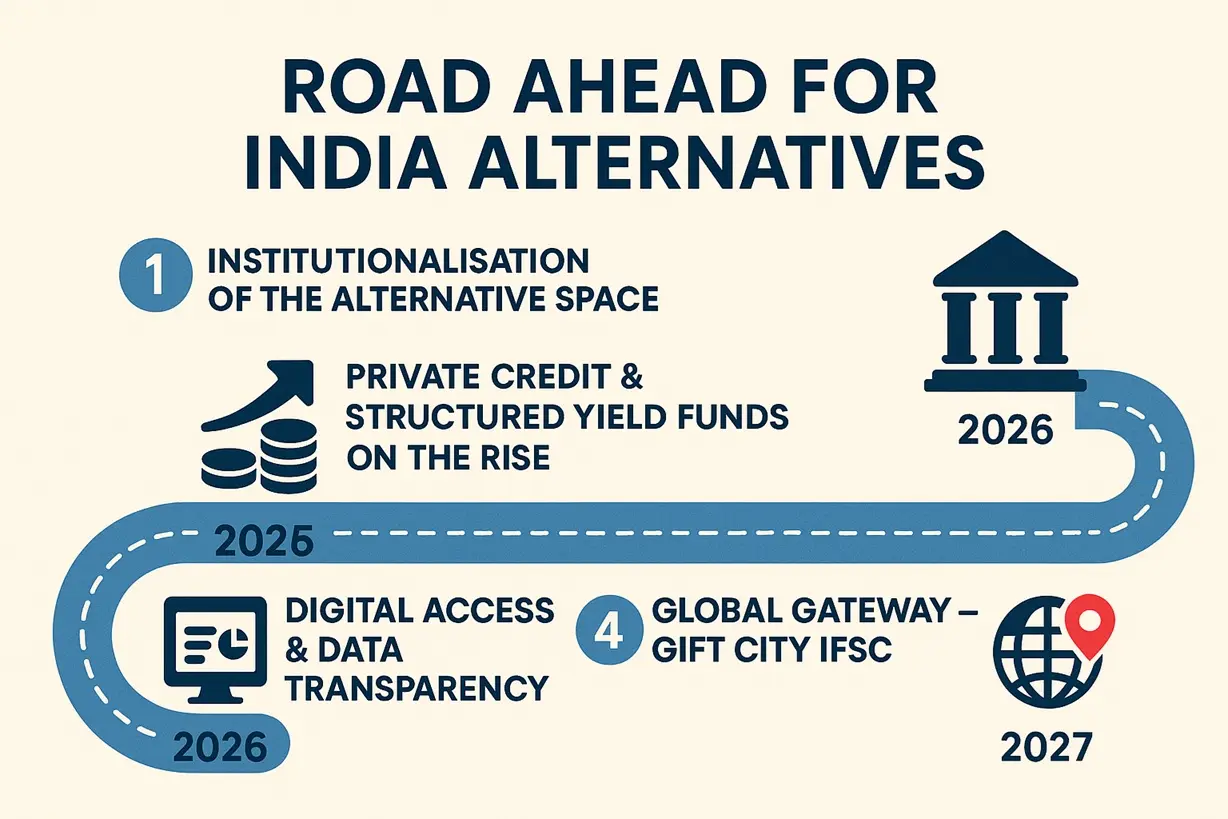

The Future of Alternatives in India – Trends Shaping 2026 & Beyond

A decade ago, India’s wealth landscape was dominated by mutual funds and direct equities. By 2025, Alternatives — AIFs and PMS — have become the chosen playground for sophisticated HNIs seeking diversification, governance, and differentiated alpha. But what lies ahead?

1️⃣ Institutionalisation of the Alternative Space

SEBI’s continuous tightening of disclosure norms and valuation standards is transforming AIFs into globally benchmarked structures. Independent trustees, auditors, and custodians are now standard, paving the way for larger institutional inflows, including insurance and pension allocations. Expect 2026 to be the year when global allocators formally recognise Indian alternatives as a credible emerging-market sleeve.

2️⃣ Private Credit & Structured Yield Funds on the Rise

As India’s corporate credit markets deepen, Category II AIFs are emerging as the new “yield engines.” We’ll see more sector-specialised credit vehicles — real-estate mezzanine, renewable infra debt, supply-chain receivable pools — with predictable cash flows but carefully underwritten collateral.

3️⃣ Thematic & Impact AIFs – Purpose Meets Profit

India’s sustainable-finance movement is catching global attention. Expect ESG-aligned and impact-driven AIFs – from renewable energy to healthcare – to grow rapidly. HNIs are beginning to treat “responsible alpha” as a parallel goal to returns.

4️⃣ Digital Access & Data Transparency

By 2026, we’ll likely see SEBI-verified dashboards where investors can track NAVs, audit updates, and stress-testing results in real time. Technology will make reporting frictionless, moving AIFs closer to the transparency of PMS platforms.

5️⃣ Global Gateway – GIFT City IFSC

The International Financial Services Centre (IFSC) in GIFT City will redefine how NRIs and global funds access Indian assets. Expect feeder-fund regimes, tax parity with global domiciles, and smoother cross-border settlements.

Key Takeaway: India’s AIF & PMS ecosystem is graduating from boutique to institutional. 2026 will belong to managers who combine transparency, domain depth, and technology.

Disclaimer: Educational content only; not investment advice. Market risks apply. Consult SEBI-registered advisors before investing.