The Hidden Risks in Venture Debt — And How to Evaluate Them

Venture debt offers attractive double-digit yields, but the risks are very different from traditional private credit. Borrowers are high-growth companies with limited profitability and evolving business models.

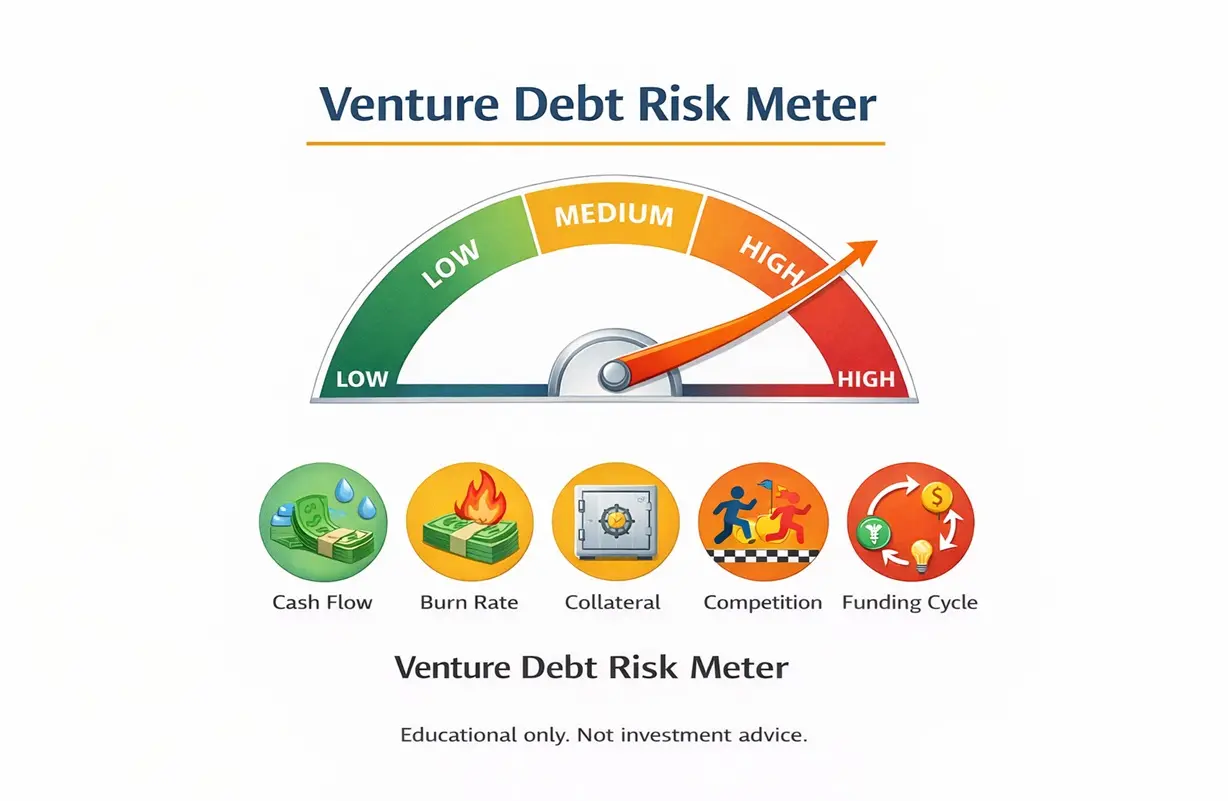

Key risks include:

• Cash-flow uncertainty

• High burn rates

• Dependence on future equity raises

• Collateral limitations

• Rapid market shifts in tech sectors

Evaluating venture debt requires assessing runway, founder quality, equity sponsor strength, business model scalability, and the company’s ability to refinance or raise capital.

Well-structured venture debt — with board rights, warrants, covenants, and escrow controls — can deliver strong asymmetric returns. Poorly structured deals can lead to permanent impairments.

Truvest Insight:

Venture debt works when structure protects against uncertainty.

Disclaimer:

Educational only. Not investment advice.