Volatility Management in PMS & AIF – How Professionals Control the Downside

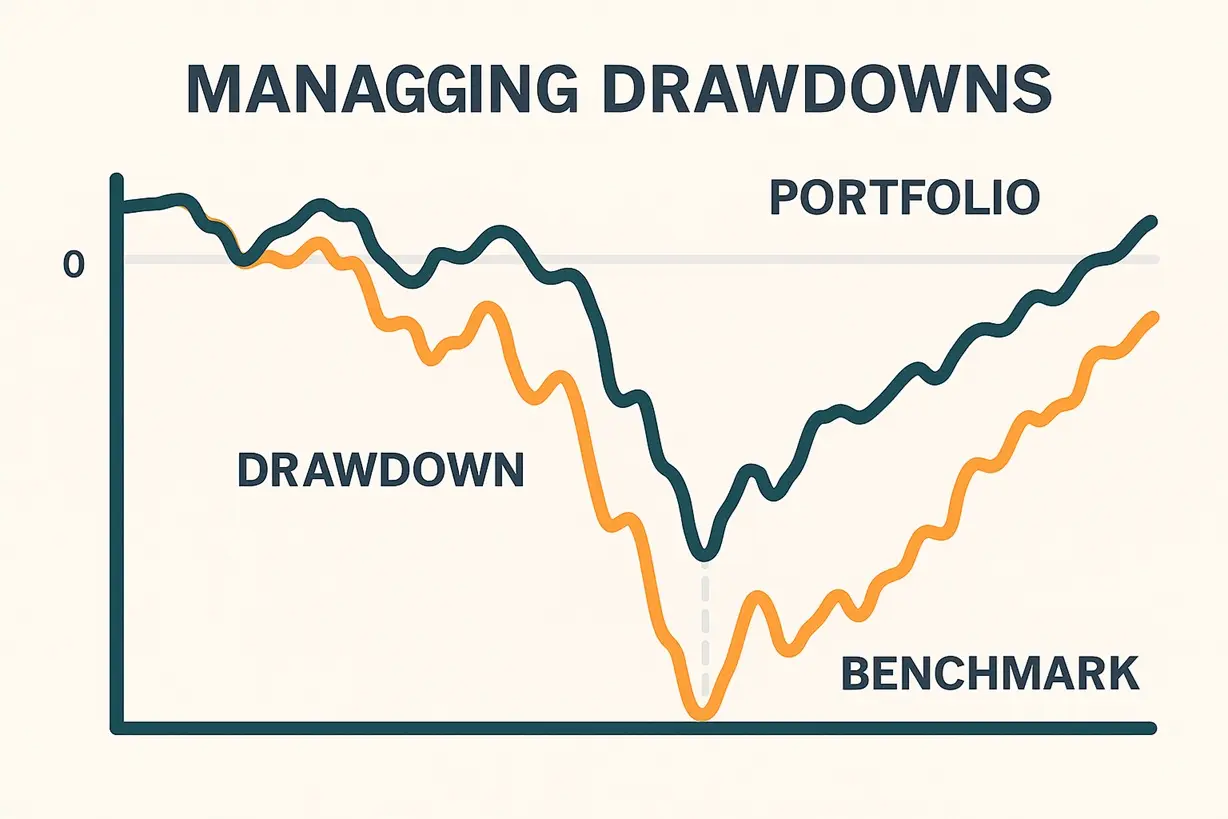

Markets don’t move in straight lines. The difference between surviving and succeeding lies in how your manager handles volatility.

Within PMS

Managers use sector rotation, cash buffers, and factor-based hedges to smooth drawdowns. Defensive allocation to FMCG or utilities often counters cyclical weakness.

Within AIFs

Hedge-style funds may short indices or buy options as insurance. Private-credit AIFs monitor coverage ratios and collateral margins monthly to anticipate stress.

Investor Checklist

Ask for maximum drawdown history and volatility metrics like standard deviation or Sharpe ratio. Focus on risk-adjusted returns, not headline CAGR.

Key Takeaway: It’s not about avoiding storms but having a tested umbrella ready.

Disclaimer: Educational only.