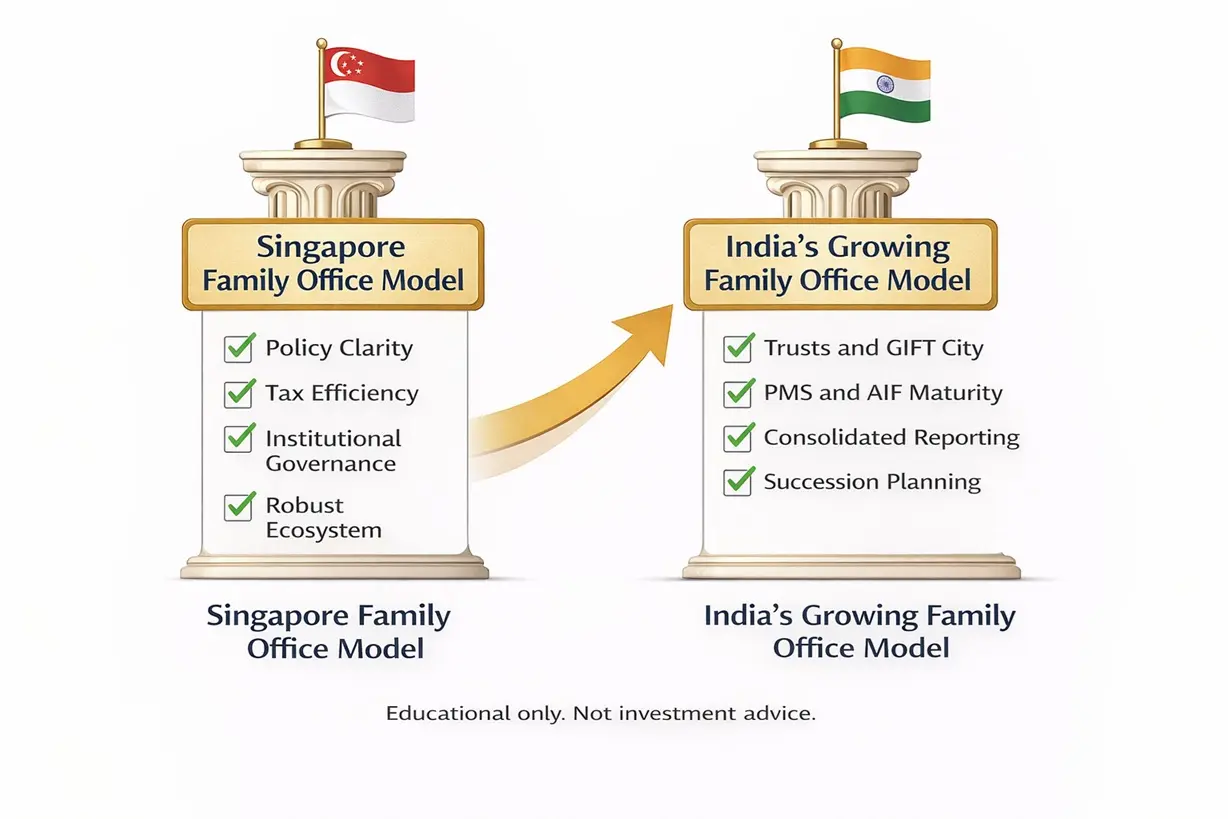

What India Can Learn From Singapore’s Family Office Ecosystem

Singapore is the global benchmark for family office excellence. Its success comes from four pillars: policy clarity, tax efficiency, institutional-quality governance, and a robust ecosystem of advisors, bankers, and specialists.

India is moving in this direction — with trusts, PMS, AIF, and GIFT City structures gaining maturity. But key lessons include:

• Consolidated reporting dashboards

• Long-term evergreen vehicles

• Global diversification

• Succession frameworks

• Professional investment committees

As India’s wealth grows, family offices are evolving from informal groups to institutional platforms. The next decade will see India building its own world-class ecosystem.

Truvest Insight:

India has wealth; Singapore has structure.

The future belongs to families who combine both.

Disclaimer:

Educational only. Not investment advice.