Why Structured Equity Deals Are Becoming Popular Among HNIs

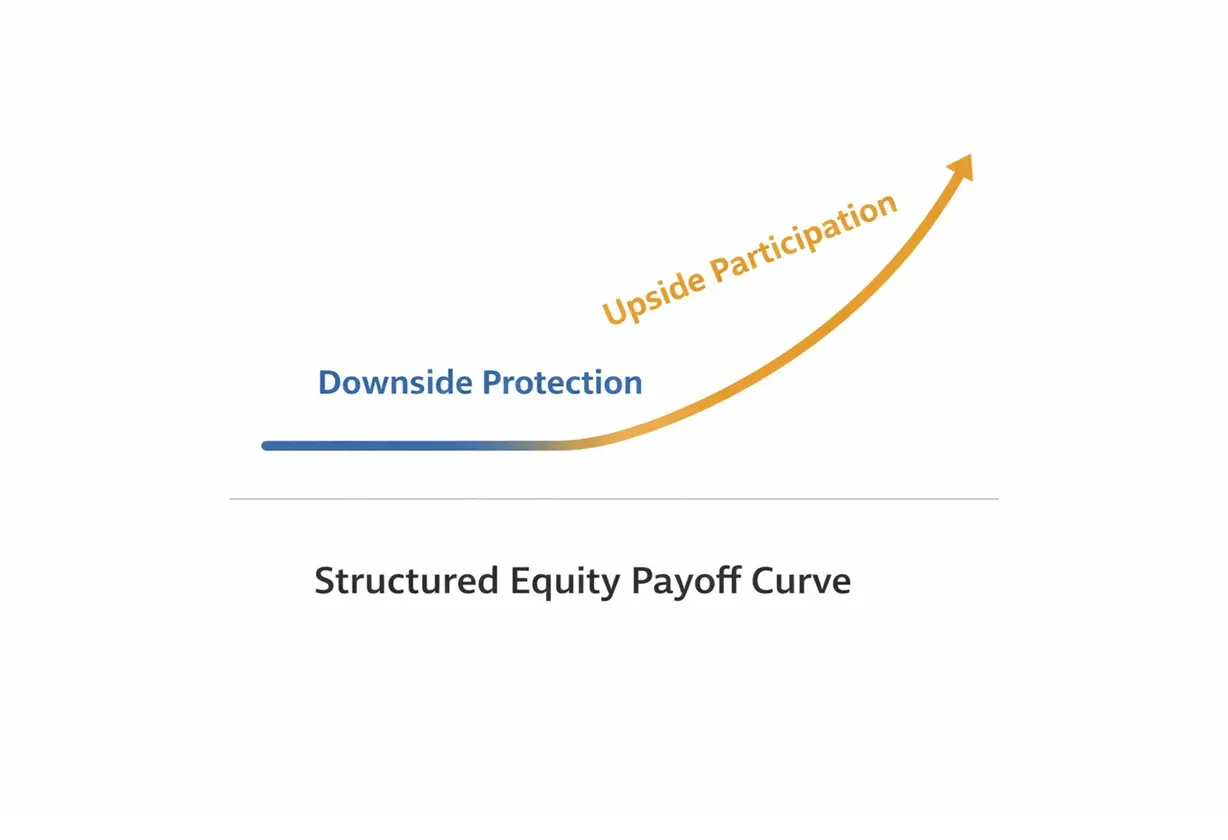

Structured equity combines features of equity and debt — offering upside participation with downside protection. As volatility rises, HNIs prefer instruments that offer asymmetric payoff: limited downside, meaningful upside.

These structures can include:

• Capital protection floors

• Coupon-linked returns

• Equity kickers

• Performance-linked upside

• Downside buffers

They are increasingly used in private deals, promoter financing, and late-stage growth funding. For HNIs, structured equity provides exposure to high-quality companies without taking full equity risk.

The appeal lies in the predictability of outcomes: you define your return range before investing.

Truvest Insight:

Structured equity turns uncertainty into risk-shaped opportunity.

Disclaimer:

Educational only. Not investment advice.